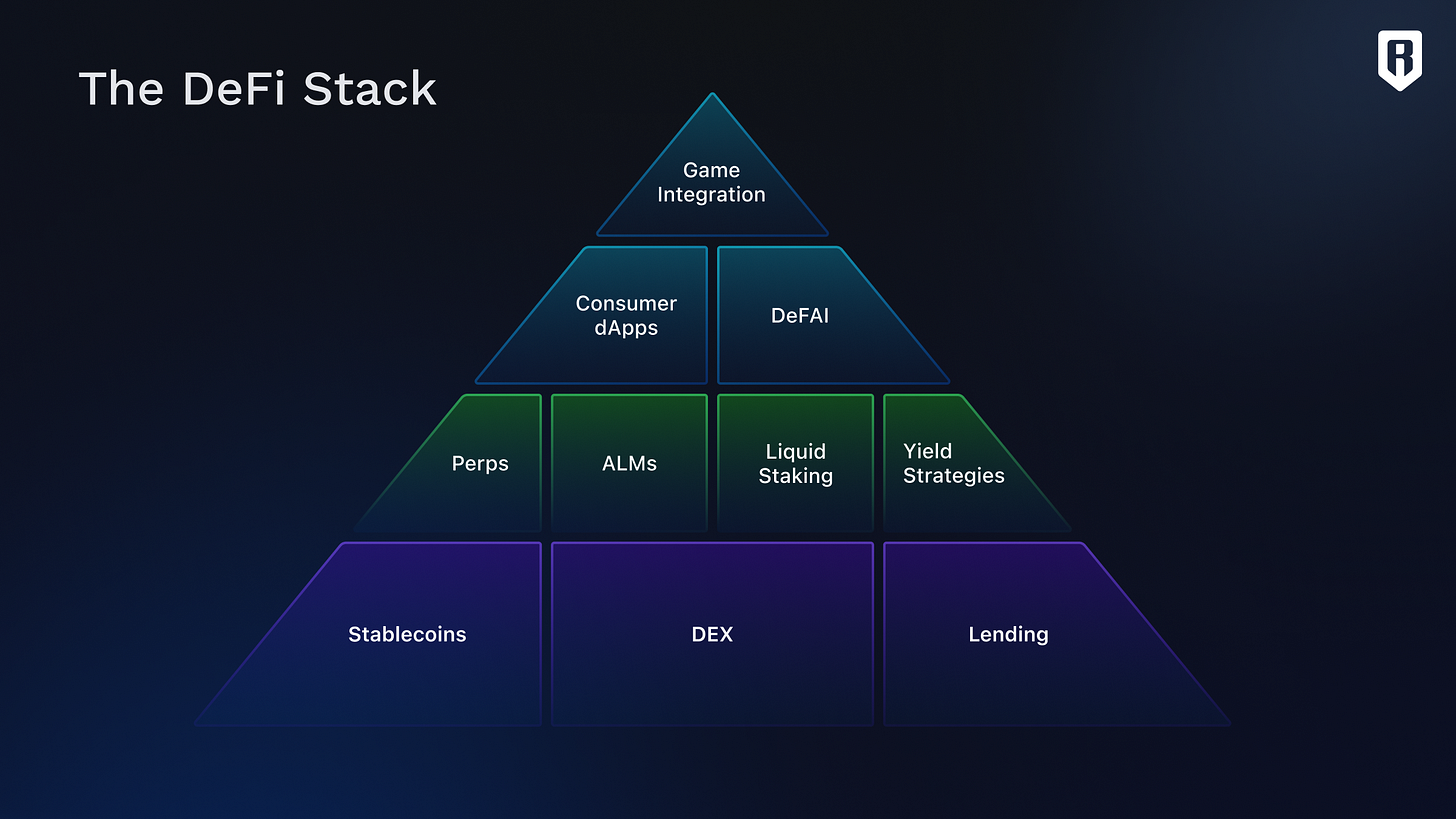

As Ronin pivots from its origins as a sidechain for Axie Infinity to a full-fledged Ethereum Layer 2 rollup, the conversation around decentralization and security trade-offs has become more urgent. This transformation isn’t just technical; it directly impacts user trust, developer incentives, and the long-term viability of the Ronin ecosystem. At the current price of $0.4908, Ronin’s market position reflects both anticipation and skepticism about these architectural changes.

Ronin’s Journey: From Sidechain to Ethereum L2

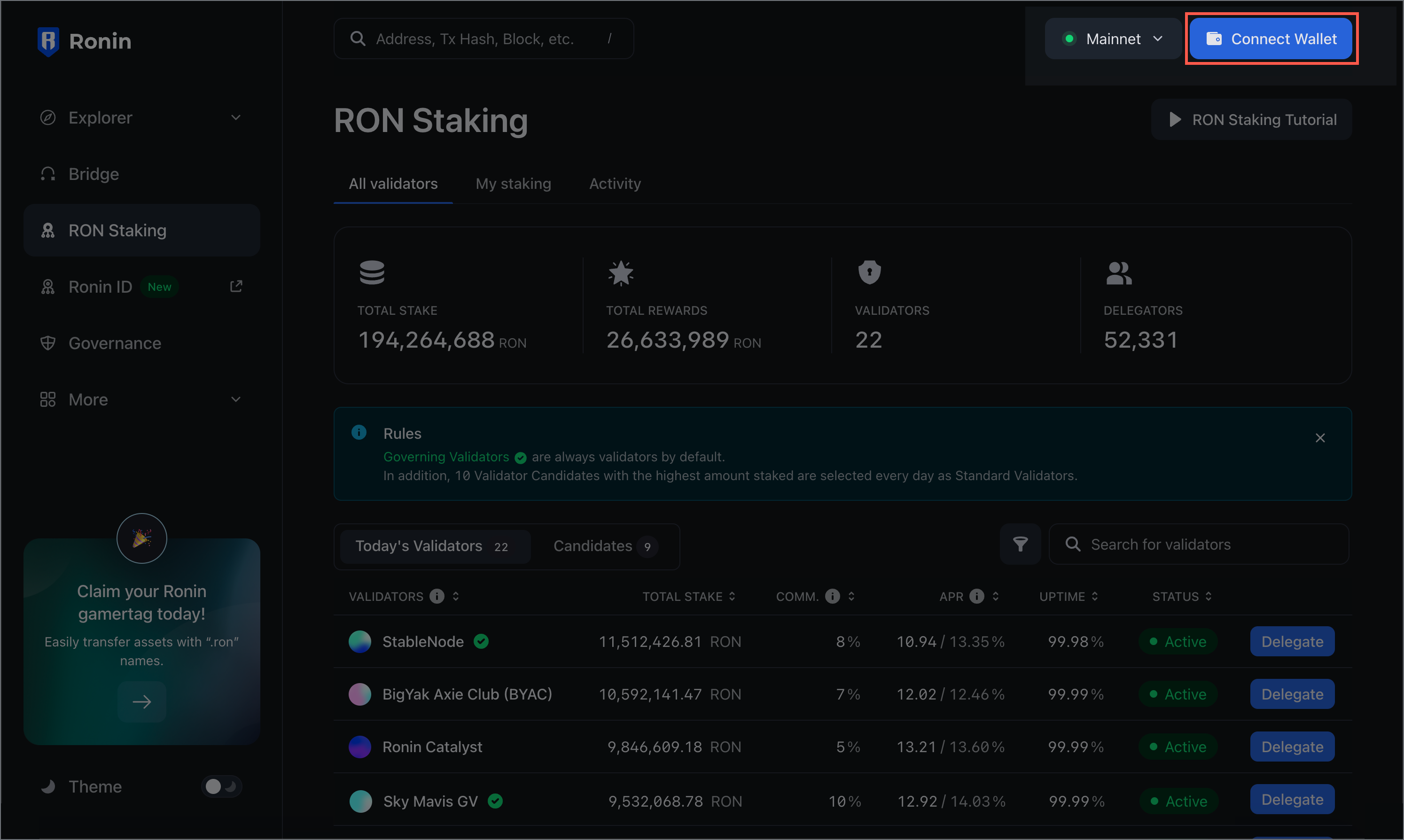

Originally, Ronin operated on a Proof of Authority (PoA) model, fast but highly centralized, with security bottlenecked around a handful of validators. In 2023, the move to Delegated Proof of Stake (DPoS) expanded validator participation and increased decentralization. Yet even with DPoS, sidechains like Ronin often struggled to match Ethereum mainnet’s security guarantees. This led to a strategic pivot: by adopting zkEVM technology and rolling up onto Ethereum as an L2, Ronin aims to inherit Ethereum’s robust security while maintaining its own economic independence (source).

The upcoming transition, expected in early 2026, will see Ronin leveraging zero-knowledge proofs for both scalability and privacy. By anchoring L2 transactions onto Ethereum’s mainnet, the network can offer users faster execution (reportedly 12x improvement) without shouldering all security responsibilities alone (source). This is particularly relevant as rollup strategies across the industry diverge between maximizing user experience speed versus aligning deeply with mainnet security.

The Security Model: Inheriting Trust from Ethereum

The core promise of Layer 2 scaling is that even if L2 validators are compromised or collude, users can still prove their transaction validity on L1 (Ethereum). With zkEVM integration planned for Q1 2025, every transaction on Ronin will be verifiable against Ethereum’s consensus rules (source). This approach dramatically reduces sequencer risk, the danger that a single entity could censor or reorder transactions, and strengthens censorship resistance.

However, this inherited security comes at a cost:

- L2 censorship resistance is only as strong as the mechanisms that allow users to exit or challenge invalid transactions on L1.

- Sequencer risk persists if there is only one operator batching transactions before submitting them to Ethereum, a common design in many rollups today.

- L1 dependency: If Ethereum experiences congestion or high fees, it can impact settlement times and costs on Ronin L2.

The trade-off matrix is clear: greater decentralization usually means slower governance and response times; tighter alignment with Ethereum boosts security but can limit local sovereignty over protocol upgrades and revenue streams.

Decentralization in Practice: Governance and Validator Dynamics

The transition also raises questions about governance. As an independent sidechain, Ronin enjoyed full control over its consensus rules and upgrades. Becoming an L2 means ceding some autonomy back to the Ethereum ecosystem, a move that could restrict rapid innovation but ensures stronger defense against validator collusion or attacks.

This tension is not unique to Ronin; it reflects broader industry debates about composability versus sovereignty and local revenue capture versus global alignment (source). For developers building on top of Ronin L2, these choices will shape everything from protocol economics to dApp interoperability in 2026 and beyond.

Ronin (RON) Price Prediction 2026-2031

Forecast based on Ronin’s Layer 2 transition, Ethereum alignment, and evolving tokenomics (2025 Baseline: $0.4908)

| Year | Minimum Price (Bearish) | Average Price | Maximum Price (Bullish) | % Change (Avg vs. Prev Year) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $0.44 | $0.65 | $0.92 | +32% | L2 launch, increased adoption, but initial volatility as new tokenomics roll out |

| 2027 | $0.60 | $0.88 | $1.24 | +35% | Network effect grows, more dApps & games migrate, Ethereum L2 narrative strengthens |

| 2028 | $0.75 | $1.10 | $1.58 | +25% | Sustained user growth, improved interoperability, regulatory clarity supports expansion |

| 2029 | $0.95 | $1.30 | $1.95 | +18% | Mainstream gaming adoption, robust Layer 2 ecosystem, competition intensifies |

| 2030 | $1.10 | $1.50 | $2.30 | +15% | Ronin solidifies as a top gaming L2, tokenomics stabilize, broader crypto bull market |

| 2031 | $1.25 | $1.70 | $2.70 | +13% | Long-term Ethereum integration, mature governance, potential for cross-chain leadership |

Price Prediction Summary

Ronin’s transition to a Layer 2 Ethereum rollup is expected to enhance security, scalability, and composability, driving steady price appreciation over the next six years. The average price could rise from $0.65 in 2026 to $1.70 by 2031, with bullish scenarios reaching as high as $2.70 if adoption and market conditions are favorable. However, initial volatility and competition from other L2s may result in wide price ranges, especially during the early years of the transition.

Key Factors Affecting Ronin Price

- Successful execution of Layer 2 transition and zkEVM implementation

- Adoption by new games and dApps leveraging Ronin’s infrastructure

- Competition from other Ethereum Layer 2s and alternative gaming chains

- Evolution and effectiveness of new tokenomics and developer incentives

- Macro crypto market cycles (bull/bear trends)

- Security incidents or regulatory changes impacting Layer 2s

- Integration with Ethereum’s broader ecosystem and composability improvements

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Balancing these trade-offs is not simply a technical challenge, it’s a question of ecosystem philosophy. Ronin’s move to Layer 2 brings it closer to Ethereum’s security guarantees, but the cost is a more complex governance structure and potential friction in protocol upgrades. Developers and token holders must weigh the benefits of inheriting Ethereum-grade security against the slower, sometimes contentious, decision-making processes that come with increased decentralization.

One immediate advantage of this architecture is enhanced censorship resistance. If an L2 sequencer attempts to block or reorder transactions, users can appeal directly to Ethereum for finality and dispute resolution. This safety net is vital for high-value gaming ecosystems and DeFi protocols where trust assumptions are paramount. Yet, the risk of centralized sequencer bottlenecks remains until fully decentralized sequencing becomes standard practice across all rollups.

Developer Incentives: Tokenomics and Economic Alignment

The upcoming overhaul in Ronin’s tokenomics, slated for the first half of 2026, will further shift incentives toward developers. As outlined in recent market updates, this model aims to reward builders who contribute to network activity, rather than just passive validators or early adopters. The hope is that this will stimulate more robust dApp growth while maintaining economic independence from Ethereum’s fee markets (source).

For RON holders, the current price of $0.4908 reflects both optimism about future scalability and lingering questions around how these new dynamics will play out in practice. As Layer 2 competition heats up, networks that can best align developer rewards with user growth, without sacrificing security, are likely to capture outsized mindshare and liquidity.

Key Trade-offs in Ronin L2 Security vs. Decentralization

-

Security Inheritance vs. Governance Autonomy: By transitioning to an Ethereum Layer 2 rollup, Ronin inherits Ethereum’s robust security and decentralization. However, this alignment means Ronin may lose some control over its own governance and consensus mechanisms, reducing its ability to implement rapid, sovereign changes.

-

Faster User Experience vs. Validator Decentralization: Ronin’s Layer 2 approach, especially with upcoming zkEVM integration, promises 12x faster transactions and lower fees. Yet, increasing transaction speed can sometimes require a smaller, more centralized validator set, potentially limiting decentralization if not carefully managed.

-

Economic Independence vs. Mainnet Alignment: Ronin aims to retain economic independence (e.g., through RON token incentives) while leveraging Ethereum’s infrastructure. This can create tension between local revenue generation and the need to align with Ethereum’s broader economic and security models.

-

Composability vs. Sovereignty: As a Layer 2, Ronin benefits from cross-chain composability with Ethereum dApps and assets. However, this integration may reduce Ronin’s ability to maintain unique features or make unilateral protocol decisions, impacting its sovereignty.

-

Decentralized Staking vs. Security Risks: The shift to Delegated Proof of Stake (DPoS) in 2023 allowed broader participation in validator selection, enhancing decentralization. However, DPoS can introduce new risks, such as validator collusion or concentration of voting power among large RON holders.

The integration of zero-knowledge proofs through zkEVM also introduces new privacy primitives for users without compromising on verifiability, a crucial upgrade as regulatory scrutiny intensifies globally. This privacy layer could become a differentiator for Ronin against other game-centric blockchains still reliant on less secure sidechain models.

Looking Forward: What Does It Mean for Users?

Ultimately, the success of Ronin L2 hinges on its ability to deliver tangible improvements in transaction speed, cost efficiency, and user sovereignty, all while maintaining rigorous security standards. For everyday users, these changes should translate into faster gameplay experiences and safer asset custody within Axie Infinity and other flagship dApps.

But vigilance remains key: as rollup architectures evolve and new attack surfaces emerge (such as sequencer exploits or bridging vulnerabilities), both developers and users must stay informed about ongoing protocol upgrades and governance proposals. The decentralization-security spectrum is not static; it demands constant recalibration as threats, and opportunities, shift in real time.

Ronin’s journey from sidechain to Ethereum Layer 2 encapsulates the hard choices facing every scaling project: how much control are you willing to give up for stronger guarantees? And how do you keep your community engaged when trade-offs become more visible than ever?