In the rapidly evolving blockchain landscape of 2025, scalability and ecosystem flexibility have become critical differentiators for both developers and users. As Ronin Network pivots from its origins as an Ethereum sidechain to a full-fledged Layer 2 (L2) solution, questions about how it stacks up against established alternatives like BNB Chain, Solana, and MultiversX are more relevant than ever. Each platform offers a distinct approach to performance, cost-efficiency, and security, making the choice between them increasingly strategic for Web3 builders.

Ronin Layer 2: The Ethereum-Powered Challenger

Ronin L2 is undergoing a major transformation. Originally designed to serve the explosive growth of Axie Infinity’s play-to-earn ecosystem, Ronin is now positioning itself as a multi-purpose blockchain by leveraging Ethereum’s matured infrastructure. This transition to an L2 solution, targeted for completion by mid-2026, means Ronin will inherit Ethereum’s robust security guarantees while benefiting from the scalability enhancements that rollups and other L2 technologies bring.

The move aligns with broader market trends: Ethereum continues to dominate Layer 1 chain activity with a 77.81% share (according to Binance), but it is Layer 2s that are unlocking new levels of transaction speed and fee reduction. By building atop Ethereum rather than competing with it directly, Ronin can offer lower fees and faster confirmation times without sacrificing network trust or composability.

BNB Chain: Efficiency Through Proof-of-Staked-Authority

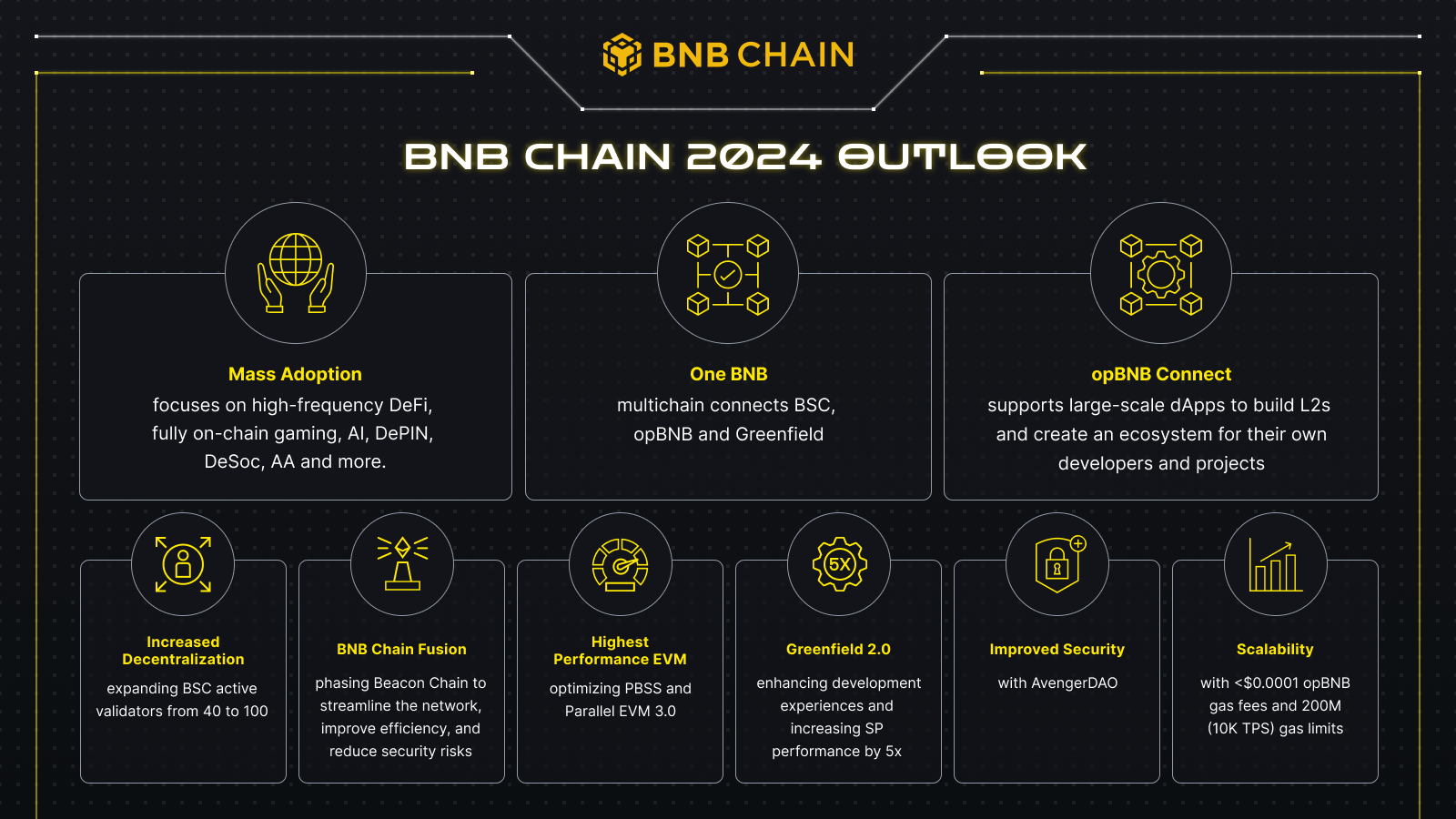

BNB Chain (Binance Smart Chain), Binance’s flagship Layer 1 blockchain, has carved out a dominant position in DeFi, gaming, and NFTs by focusing on high throughput at low cost. Its Proof-of-Staked-Authority (PoSA) consensus enables block times of just a few seconds while keeping gas fees minimal, an attractive proposition for retail users and dApp developers alike.

The EVM compatibility of BNB Chain ensures seamless migration for projects originating on Ethereum. However, compared to Ronin’s upcoming L2 architecture that leverages Ethereum’s full validator set for security, BNB Chain operates with a smaller validator group, a trade-off that delivers efficiency but may raise centralization concerns among purists.

Solana: High-Throughput Leader in Transaction Volume

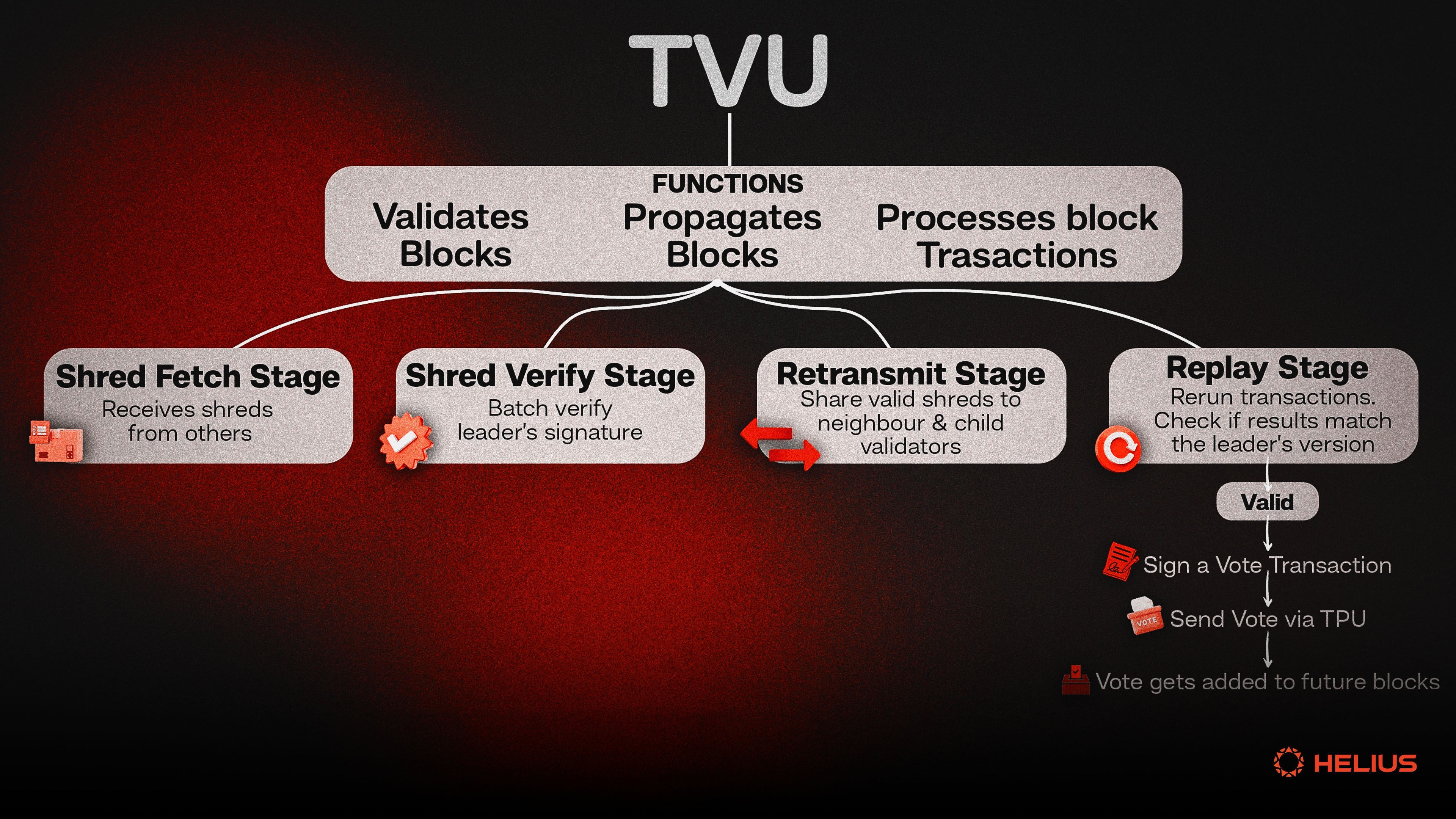

If raw transaction volume is any indication of market preference, Solana stands out in June 2025 with more than six times the transactions of BNB Chain, and over seventy times that of Ethereum itself (CryptoDnes. bg). Solana achieves this through its unique blend of Proof of History (PoH) and Proof of Stake (PoS), which allows thousands of transactions per second via parallel processing.

This scalability-first design has made Solana the go-to platform for high-frequency DeFi protocols and NFT marketplaces requiring near-instant settlement. However, its rapid growth hasn’t come without challenges; network outages have occasionally highlighted the complexity inherent in pushing throughput boundaries at scale.

How Ronin L2, BNB Chain, Solana & MultiversX Scale

-

Ronin Layer 2: Built as an Ethereum Layer 2, Ronin leverages Ethereum’s security and consensus while using rollup technology for high scalability, low fees, and fast finality. Its transition from a gaming sidechain to a multi-purpose L2 enables compatibility with Ethereum’s ecosystem and benefits from ongoing Ethereum upgrades.

-

BNB Chain (Binance Smart Chain): A Layer 1 blockchain using Proof-of-Staked-Authority (PoSA) consensus, BNB Chain achieves high throughput and low transaction costs by combining fast block times with EVM compatibility. Its scalability is driven by a streamlined validator set and wide adoption in DeFi, gaming, and NFTs.

-

Solana: As a Layer 1 blockchain, Solana’s unique Proof of History (PoH) and Proof of Stake (PoS) combination allows for parallel transaction processing, resulting in some of the highest transaction throughput in the industry. This scalability-first approach supports massive transaction volumes and low fees, making Solana a leader in real-time applications.

-

MultiversX (formerly Elrond): This Layer 1 blockchain employs Secure Proof of Stake (SPoS) and Adaptive State Sharding to distribute network load and achieve high throughput. MultiversX’s sharding architecture enables low latency and scalability for a broad range of decentralized and enterprise applications.

MultiversX: Adaptive State Sharding for Enterprise Scale

MultiversX, formerly known as Elrond, rounds out our comparison as another high-performance Layer 1 contender. Its Secure Proof-of-Stake (SPoS) mechanism combined with Adaptive State Sharding enables rapid scaling without congestion or latency spikes, a critical feature for enterprise-grade applications seeking reliability alongside speed.

The developer experience on MultiversX is enhanced by user-friendly tooling and support for diverse dApps across DeFi and enterprise verticals. While not yet matching Solana or BNB Chain in raw transaction numbers or ecosystem breadth, MultiversX’s technical innovations position it well for future adoption surges as demand shifts toward more scalable architectures.

When comparing Ronin L2 to these leading alternatives, the architectural differences become strategic levers for both developers and users. Ronin’s transition to an Ethereum L2 is more than a technical upgrade, it’s a deliberate move to anchor itself within the most trusted smart contract ecosystem while capturing the performance benefits of modern rollup technology. This approach contrasts sharply with the Layer 1-centric paths taken by BNB Chain, Solana, and MultiversX.

Security, Ecosystem Fit, and Developer Experience

Security remains a top concern for any blockchain scaling solution. Ronin L2’s reliance on Ethereum’s validator set offers arguably the strongest security guarantees in this comparison, especially relevant for projects handling high-value assets or seeking institutional adoption. In contrast, BNB Chain’s smaller validator set enables efficiency but introduces centralization risks that may not align with every project’s ethos. Solana and MultiversX both distribute consensus across broad networks, but their unique mechanisms (PoH/PoS and SPoS/sharding) present different operational trade-offs.

Ecosystem fit is also evolving. Ronin’s expansion beyond gaming signals an intent to attract DeFi, NFT, and enterprise builders who value Ethereum compatibility without its Layer 1 costs. BNB Chain excels in onboarding new dApps due to low fees and fast settlement, an advantage reflected in its recent surge in DEX trading volume (over $2.13 billion in daily transactions). Solana dominates high-frequency applications thanks to its unmatched throughput, while MultiversX is carving out a niche among enterprise-grade projects that prioritize sharding-based scalability.

The developer experience further distinguishes these platforms. Ronin L2 will enable seamless access to Ethereum tooling, liquidity pools, and composable dApps, a major draw for teams looking to tap into DeFi blue chips or migrate existing contracts with minimal friction. BNB Chain offers similar EVM compatibility but with fewer security assurances at the consensus layer. Solana’s Rust-based development stack attracts performance-focused teams but comes with a steeper learning curve; MultiversX balances developer-friendly tools with advanced features like adaptive sharding.

Key Scalability Metrics: Ronin L2 vs BNB Chain, Solana, and MultiversX

| Blockchain | Transactions Per Second (TPS) 🚀 | Average Fees 💸 | Validator Count 🛡️ | Real-World Adoption Highlights 🌍 |

|---|---|---|---|---|

| Ronin (L2) | ~2,000+* | Very Low (Layer 2, <$0.01) | Leverages Ethereum’s validator set (Over 1,000) | Originated from Axie Infinity, expanding to multi-purpose dApps |

| BNB Chain (L1) | ~150-200 | Low (<$0.10) | ~50-60 | Leading DeFi and DEX volume, strong NFT and gaming presence |

| Solana (L1) | ~2,000+ (peaks >65,000) | Ultra Low (<$0.001) | ~2,000+ | Top transaction volume, thriving DeFi, NFT, and real-time apps |

| MultiversX (L1) | ~15,000+ (theoretical) | Low (<$0.01) | ~3,200 | Enterprise adoption, DeFi, and developer-friendly ecosystem |

- Solana: Leading by transaction volume (over six times BNB Chain), ideal for applications demanding real-time responsiveness.

- BNB Chain: Competitive on cost-efficiency and DEX activity; EVM support accelerates onboarding but validator concentration remains a debate point.

- MultiversX: Not yet topping volume charts but positioned strongly for future adoption due to adaptive sharding innovations.

- Ronin L2: Poised to combine Ethereum-level security with sub-cent fees, potentially offering the best of both Layer 1 trustlessness and Layer 2 scalability.

Strategic Takeaways for Builders and Investors

The blockchain scalability race is no longer just about raw speed or theoretical throughput, it’s about aligning technical strengths with ecosystem needs as user expectations mature. Ronin L2 vs BNB Chain vs Solana vs MultiversX isn’t a zero-sum contest; rather it highlights how nuanced trade-offs shape platform selection:

- If you need ironclad security paired with access to Ethereum-native liquidity and composability: Ronin L2 emerges as an agile challenger.

- If your priority is rapid market entry at low cost within an established dApp ecosystem: BNB Chain remains formidable.

- If your use case demands extreme throughput for real-time DeFi or gaming: Solana leads in raw performance today.

- If you’re building enterprise solutions that require scalable infrastructure from day one: MultiversX offers forward-looking architecture worth watching closely.

The next wave of Web3 innovation will be shaped by these choices, and by how each platform continues to evolve under pressure from developers, users, and shifting market dynamics. For those tracking long-term trends in blockchain scalability comparison, keeping a close eye on Ronin’s mid-2026 Layer 2 launch could prove prescient as Ethereum-centric solutions gain momentum across verticals far beyond gaming.