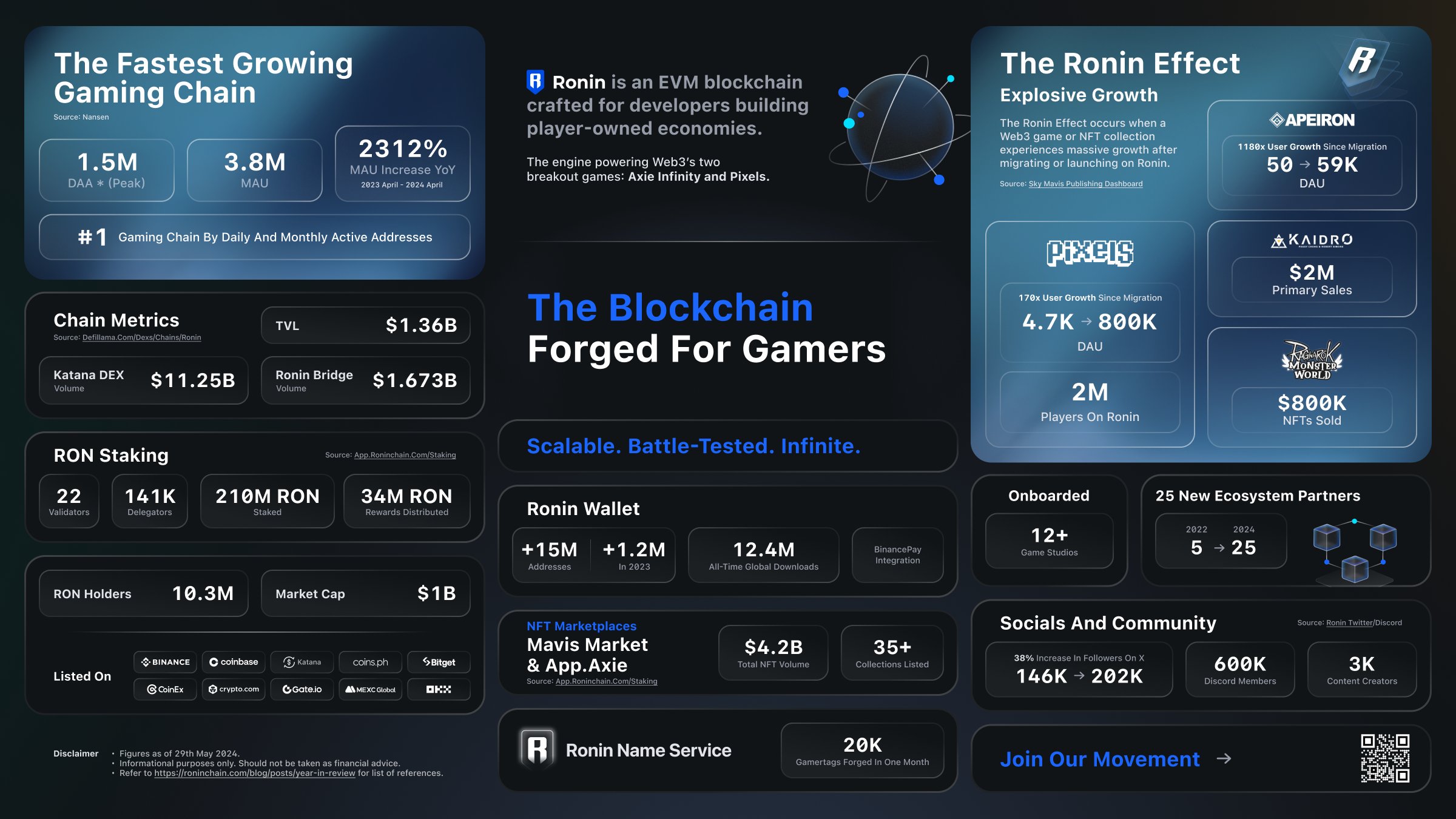

Ronin Network’s seismic shift to an Ethereum Layer 2 (L2) solution using Optimism’s OP Stack is more than a technical upgrade – it’s a strategic leap that redefines what’s possible for Web3 scalability, especially in the high-stakes world of blockchain gaming and NFT ecosystems. As of now, Ethereum (ETH) is trading at $4,511.13, reflecting robust confidence in the L2 narrative and the ongoing migration of value onto scalable infrastructure.

Why Ronin Chose the OP Stack: Speed Meets Security

Originally built as a sidechain to supercharge Axie Infinity, Ronin’s limitations were always about scale vs. security. The move to OP Stack changes that equation dramatically. According to official Ronin sources, block times are dropping to an eye-popping 100,200 milliseconds. That means up to 1 million transactions per second – a 15x speed boost over previous capabilities.

This isn’t just about faster gaming transactions; it’s about inheriting Ethereum’s battle-hardened security model. By becoming an L2, Ronin no longer needs to maintain its own consensus and validator set from scratch. Instead, it plugs into Ethereum’s decentralized security guarantees, reducing the risk profile for developers and end users alike.

Developer Incentives Supercharged: Grants and Retro Funding

The new era for Ronin isn’t just technical – it’s financial rocket fuel for builders. The network now unlocks access to Optimism’s $850 million OP Retro Fund, plus milestone-based grants ranging from $5 million to $7 million in OP, ZKC, and EIGEN tokens. This influx of capital is designed to attract top-tier talent and turbocharge ecosystem growth.

If you’re a developer eyeing the next big thing in Web3 gaming or DeFi on Ronin, these incentives are game-changing. They lower barriers for experimentation while rewarding teams that deliver real value on-chain.

Key Benefits of Joining Ronin After Its OP Stack Migration

-

Lightning-Fast Transactions: Ronin now boasts block times of just 100–200 milliseconds and can process up to 1 million transactions per second, making it one of the fastest networks for gaming and NFT applications.

-

Enhanced Security: By operating as an Ethereum Layer 2, Ronin inherits Ethereum’s robust security protocols, providing a safer environment for developers and users alike.

-

Lucrative Developer Incentives: Builders on Ronin can tap into Optimism’s $850 million OP Retro Fund and access $5–7 million in milestone-based grants (OP, ZKC, and EIGEN tokens) to fuel innovation and growth.

-

Superchain Integration: Ronin is now part of Optimism’s Superchain, enabling interoperability with platforms like Coinbase’s Base and Uniswap’s Unichain for seamless asset transfers and cross-platform collaboration.

-

Lower Transaction Costs: As an Ethereum L2, Ronin users benefit from significantly reduced gas fees, with ongoing expenses limited to Ethereum data availability fees and proof costs—a major upgrade from standalone sidechains.

-

Boosted Ecosystem Growth: The migration unlocks greater access to Ethereum’s thriving developer community and the broader Web3 ecosystem, accelerating adoption and network effects.

Superchain Connectivity: A New Era of Interoperability

By integrating into Optimism’s Superchain, a web of interconnected L2s like Coinbase’s Base and Uniswap’s Unichain, Ronin becomes part of a broader movement toward seamless composability across Web3 applications. This means assets can move frictionlessly between platforms, unlocking powerful use cases for cross-game NFTs, pooled liquidity for DeFi protocols, and collaborative DAOs that span multiple chains.

The Superchain vision is all about breaking down silos so developers can build once and deploy everywhere within this L2 ecosystem, a huge win for user experience and network effects.

Ronin (RON) Price Prediction 2026-2031

Professional outlook on RON post-Ethereum L2 migration with OP Stack integration, using 2025 market data as a baseline.

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (%) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3.20 | $4.60 | $7.80 | +15% | Post-L2 adoption continues, with growing developer incentives and user base; adoption ramps up but competition remains high. |

| 2027 | $3.90 | $6.10 | $10.20 | +33% | Ecosystem matures, more gaming/NFT projects deploy on Ronin; broader Ethereum L2 adoption; bullish scenario if Superchain integration drives more volume. |

| 2028 | $4.60 | $7.80 | $13.50 | +28% | Web3 gaming mainstream, Ronin benefits from Superchain and cross-chain DeFi; regulatory clarity improves investor confidence. |

| 2029 | $5.10 | $8.90 | $16.80 | +14% | Continued network growth, possible new partnerships; potential volatility from broader crypto cycles. |

| 2030 | $5.80 | $10.40 | $20.00 | +17% | Mass adoption of blockchain gaming and NFT marketplaces; Ronin well-positioned if it maintains developer momentum. |

| 2031 | $6.50 | $12.20 | $24.00 | +17% | Mature L2 market; Ronin’s value driven by sustained user growth, interoperability, and ecosystem expansion. |

Price Prediction Summary

Ronin’s strategic migration to Ethereum Layer 2 with Optimism’s OP Stack is poised to significantly boost its scalability, security, and developer appeal. This move positions Ronin competitively within the rapidly expanding Web3 and gaming sectors. Over the next six years, RON is expected to see progressive price growth, with upside potential driven by increasing adoption, ecosystem incentives, and broader L2 integration. However, price volatility due to competition, market cycles, and regulatory changes should be anticipated.

Key Factors Affecting Ronin Price

- Successful migration and adoption of OP Stack and Superchain.

- Sustained developer incentives and grant programs.

- Growth of Web3 gaming and NFT ecosystems.

- Competition from other L2s (Arbitrum, Polygon, ZKsync, etc.).

- Overall crypto market cycles and ETH price trends.

- Regulatory developments affecting gaming/NFT/blockchain sectors.

- Interoperability and cross-chain DeFi integration.

- User base growth and transaction volume on Ronin.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Current Market Pulse: ETH Holds Strong at $4,511.13 Amid L2 Momentum

The timing couldn’t be better for such a transition. With Ethereum holding steady at $4,511.13, investor sentiment around scalable Layer 2 solutions has never been higher. The market is clearly rewarding projects that prioritize throughput without sacrificing decentralization or composability.

What makes this migration especially compelling is how it positions Ronin to serve not just Axie Infinity but a new generation of high-throughput, low-latency Web3 applications. Developers can now leverage the OP Stack’s modularity to deploy custom rollups tailored for everything from real-time gaming economies to NFT marketplaces, all while benefiting from Ethereum’s robust security and liquidity base.

For end users, these upgrades are more than technical jargon. Expect lower fees, faster confirmations, and a smoother onboarding process, key ingredients for mainstream adoption. No longer will congestion or high gas fees be a bottleneck for in-game asset swaps or NFT trades. Instead, Ronin’s L2 architecture delivers the kind of seamless experience that gamers and DeFi users have long demanded.

Technical Deep Dive: Ronin Rollups Unleashed

The heart of Ronin’s new scalability lies in its rollup design. By batching thousands of transactions off-chain and settling them on Ethereum, Ronin dramatically reduces costs while maintaining verifiable security. This approach is especially potent when paired with the OP Stack’s open-source flexibility, developers can fine-tune execution environments or experiment with novel data availability solutions as the ecosystem matures.

Moreover, by aligning with Optimism’s roadmap, Ronin gains access to future upgrades like fault proofs and advanced bridging mechanisms. This ensures that as Ethereum itself evolves (think proto-danksharding or EIP-4844), Ronin stays at the cutting edge of L2 innovation without needing to reinvent the wheel each cycle.

The Competitive Landscape: Ronin vs Other L2s

With major players like Arbitrum, Polygon, and ZKsync also vying for developer mindshare, Ronin’s OP Stack migration sets it apart in several ways. Its gaming-first heritage gives it a unique edge in user acquisition and ecosystem loyalty, traits that are hard to replicate overnight.

But perhaps more importantly, its embrace of Superchain interoperability signals a willingness to collaborate rather than compete head-to-head on every front. This not only diversifies risk but also maximizes network effects across the wider Ethereum L2 landscape.

Which feature of Ronin’s OP Stack migration excites you most?

Ronin is moving to Ethereum Layer 2 using Optimism’s OP Stack, bringing huge improvements in speed, security, developer incentives, and interoperability with the Superchain. Which upgrade are you most excited about for the future of Web3 and blockchain gaming?

Looking Ahead: Ronin as a Blueprint for Web3 Scalability

The big takeaway? Ronin’s OP Stack migration is about much more than Axie Infinity or blockchain gaming. It’s an architectural shift that demonstrates how Layer 2 scaling isn’t just possible, it’s practical at scale right now. As more projects follow suit and tap into the Superchain vision, expect even greater composability among DeFi protocols, NFT platforms, and DAOs across chains.

For developers eyeing milestone grants or users seeking lightning-fast transactions at minimal cost, this is your moment to get involved. And with ETH holding firm at $4,511.13, all signals point toward continued growth for both Ethereum Layer 2 networks and their native assets like RON.

If you want deeper technical breakdowns or live price action on RON and ETH as this story unfolds, keep it locked right here on RoninDaily. com.