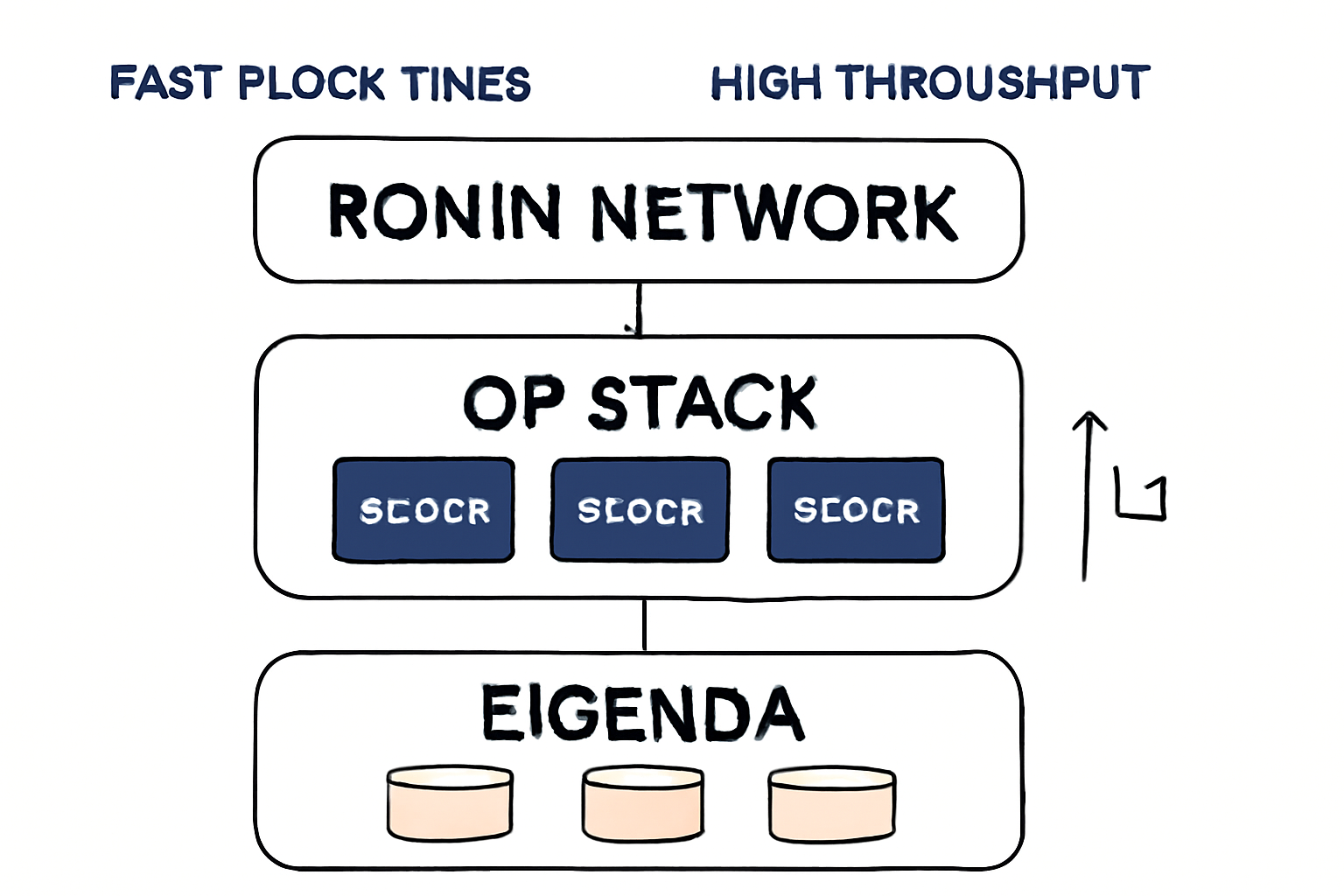

Ronin’s migration to Ethereum Layer 2 using Optimism’s OP Stack and EigenDA is a watershed moment for blockchain scalability, especially for the gaming sector. With Ronin (RON) currently priced at $0.3818, this strategic pivot positions the network to deliver finality speeds and throughput that were previously unattainable, targeting up to 1 million transactions per second (TPS). Let’s break down the technical architecture behind this leap and examine why it matters for developers, gamers, and DeFi builders alike.

How the OP Stack Supercharges Ronin’s Scalability

The OP Stack is a modular, open-source framework developed by Optimism, designed to empower Ethereum Layer 2 solutions with high throughput and robust security. By integrating with the OP Stack, Ronin transitions from a standalone sidechain to a true Ethereum L2, inheriting Ethereum’s security guarantees while unlocking new performance benchmarks.

- Ultra-fast Block Times: Ronin now achieves block times between 100 and 200 milliseconds, a dramatic improvement over legacy L1 and sidechain architectures. This enables a seamless user experience for high-frequency applications like gaming and NFT trading.

- Up to 1M TPS: The modularity of the OP Stack allows Ronin to scale horizontally and vertically, supporting transaction loads on par with mainstream payment networks.

- Security Inheritance: As an L2, Ronin leverages Ethereum’s battle-tested security model, significantly reducing risks associated with standalone chains.

For developers, the OP Stack integration means access to Optimism’s extensive ecosystem, including the 850 million $OP Retro Fund and seamless interoperability with other Superchain members like Base and Uniswap. This is a game-changer for dApp composability and cross-chain liquidity.

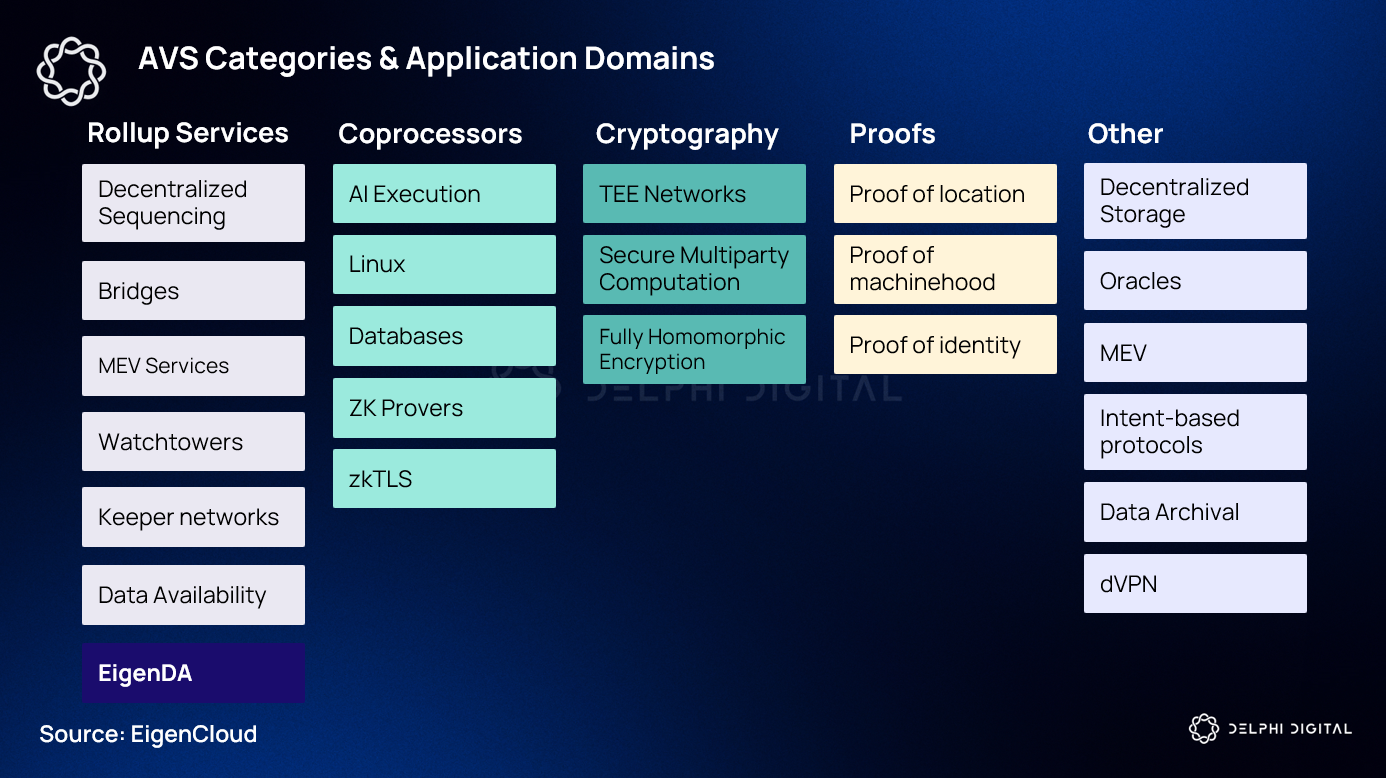

EigenDA: The Data Availability Engine Behind 1M TPS

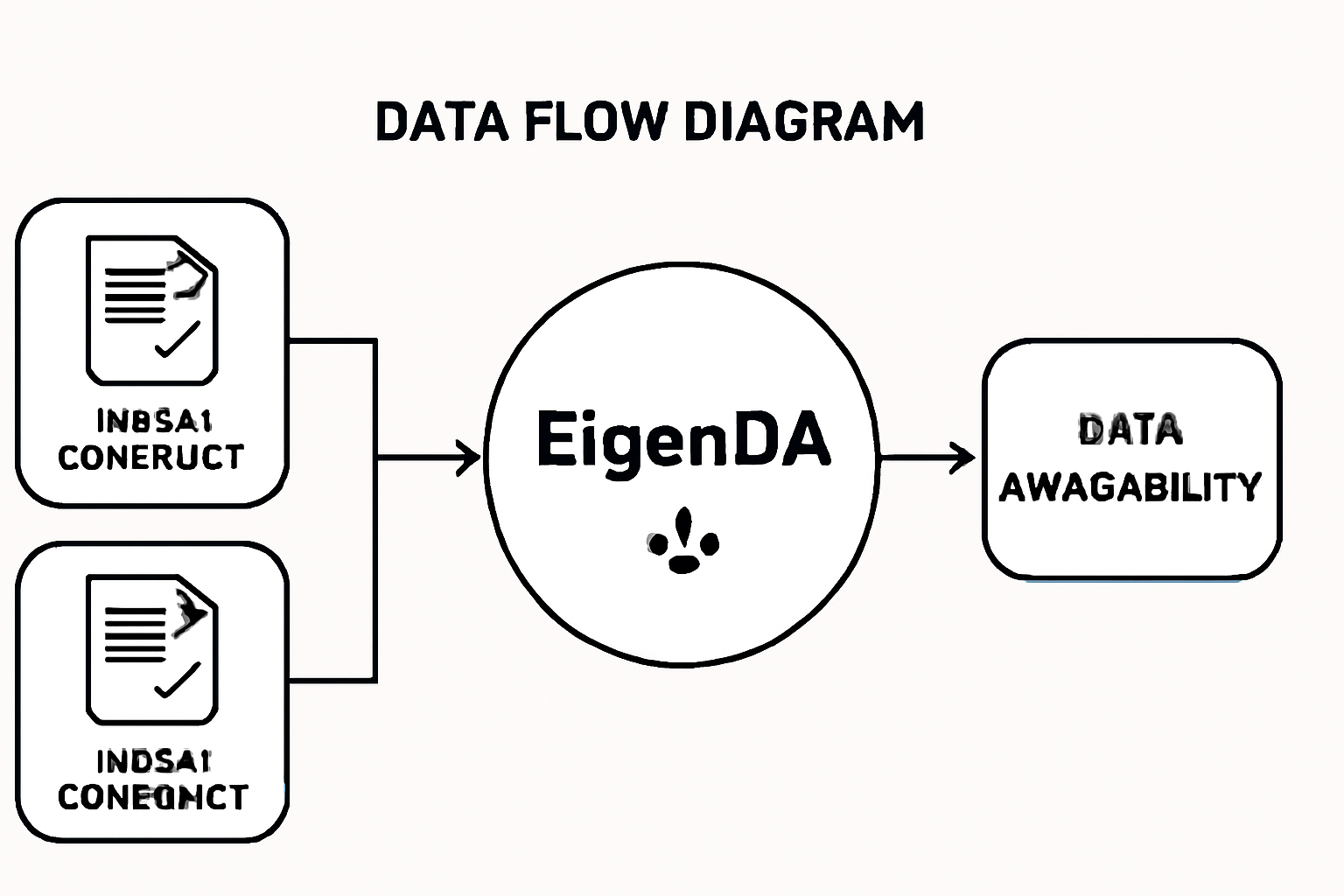

While transaction execution speed is critical, scaling Ethereum also hinges on efficient data availability. This is where EigenDA comes into play. EigenDA is a high-throughput data availability layer developed by EigenLayer, purpose-built to address one of blockchain’s most persistent bottlenecks.

- Vertical Scaling: EigenDA supports thousands of TPS per shard by separating data availability from execution, allowing Ronin to process and verify massive volumes of transactions in parallel.

- Instant Data Access: By ensuring that transaction data is always accessible and verifiable by validators and users, EigenDA enhances both security and user experience.

- Cost Efficiency: Through partnerships with Boundless and targeted incentives (including EIGEN tokens to subsidize data availability costs), Ronin projects can build at scale without prohibitive overhead.

This technical synergy between the OP Stack and EigenDA is what enables Ronin to credibly target 1M TPS without sacrificing decentralization or composability.

Ronin (RON) Price Prediction 2026–2031

Expert Forecasts Incorporating OP Stack & EigenDA Integration, Market Trends, and Adoption Potential

| Year | Minimum Price | Average Price | Maximum Price | Yearly % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.32 | $0.44 | $0.62 | +15% | Stabilization after OP Stack integration. Gaming adoption grows, but broader market volatility may limit upside. |

| 2027 | $0.38 | $0.58 | $0.85 | +32% | Bullish sentiment as Superchain ecosystem matures; Ronin attracts new gaming projects. Regulatory clarity boosts confidence. |

| 2028 | $0.49 | $0.74 | $1.10 | +28% | Wider L2 adoption and improved interoperability drive user growth. Competition from other gaming chains keeps price in check. |

| 2029 | $0.62 | $0.96 | $1.45 | +30% | Ronin secures its place as a top gaming L2. DeFi integration and new use cases add value, but macro headwinds possible. |

| 2030 | $0.83 | $1.22 | $1.88 | +27% | Mass adoption of blockchain gaming and increased NFT activity on Ronin fuel strong upward momentum. |

| 2031 | $0.98 | $1.55 | $2.40 | +27% | Mature ecosystem with sustainable growth. Ronin benefits from Ethereum upgrades and robust developer incentives. |

Price Prediction Summary

Ronin (RON) is poised for significant growth following its strategic transition to an Ethereum Layer 2 via the OP Stack and EigenDA integration. Short-term price action may remain constrained by market volatility, but long-term prospects are strong as Ronin leverages enhanced scalability, security, and access to Ethereum’s broader ecosystem. Progressive adoption in blockchain gaming, DeFi, and NFTs could propel RON toward the $2 mark by 2031 under favorable conditions. However, competition and broader market cycles will influence the trajectory.

Key Factors Affecting Ronin Price

- Success of OP Stack and EigenDA integration in delivering promised scalability and security.

- Adoption rate of Ronin by new and existing gaming projects.

- Broader market cycles impacting risk appetite for altcoins.

- Regulatory developments around gaming tokens and Layer 2 solutions.

- Continued incentives and grant funding to attract developers and users.

- Interoperability within the Superchain and with major DeFi/NFT platforms.

- Potential technological upgrades or disruptions from competing Layer 2s.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Ecosystem Incentives: Fueling Developer and Community Growth

The Ronin OP Stack migration is not just about raw throughput; it’s also designed to supercharge ecosystem incentives. The OP Foundation, in collaboration with Eigen Labs and Boundless Foundation, is injecting $5–$7 million in grants and incentives. This includes:

- $OP tokens for developer grants and ecosystem expansion

- EIGEN tokens to offset data availability costs for builders

- Targeted airdrops for active community members and dApp creators

These incentives are engineered to attract top-tier developer talent and accelerate the deployment of high-impact dApps across gaming, DeFi, and NFT infrastructure.

Ronin (RON) Price Prediction 2026-2031

Outlook based on OP Stack & EigenDA Integration, Market Trends, and Blockchain Gaming Adoption

| Year | Minimum Price | Average Price | Maximum Price | Yearly % Change (Avg) | Key Market Scenarios |

|---|---|---|---|---|---|

| 2026 | $0.35 | $0.48 | $0.70 | +26% | Post-integration adoption accelerates, but gaming market volatility persists |

| 2027 | $0.40 | $0.65 | $0.95 | +35% | Superchain and DeFi integration drive user growth; regulatory clarity improves |

| 2028 | $0.55 | $0.88 | $1.25 | +35% | Blockchain gaming mainstreams; broader crypto bull cycle |

| 2029 | $0.70 | $1.05 | $1.60 | +19% | NFT/game asset markets mature; scaling tech reaches mass adoption |

| 2030 | $0.90 | $1.32 | $2.05 | +26% | Ronin secures top L2 gaming platform status; new dApps and partnerships |

| 2031 | $1.10 | $1.65 | $2.55 | +25% | Interoperability with major L2s; sustainable ecosystem growth |

Price Prediction Summary

Ronin (RON) is positioned for substantial growth from 2026 to 2031, supported by its OP Stack and EigenDA integration, which unlocks high throughput and security. The price outlook anticipates a progressive climb, with average prices potentially rising from $0.48 in 2026 to $1.65 by 2031. Upside is tied to blockchain gaming adoption and DeFi integration, while downside risks include competition and market cycles. Both bullish and bearish scenarios are reflected in the min/max ranges, ensuring a balanced forecast for investors.

Key Factors Affecting Ronin Price

- Adoption of OP Stack and EigenDA, boosting scalability and security

- Growth of blockchain gaming and NFT ecosystems

- Integration into the Ethereum Superchain and DeFi protocols

- Grants, incentives, and developer funding from OP and EigenDA partners

- Regulatory developments affecting gaming and crypto assets

- Competition from other L2 and gaming-focused blockchains

- General crypto market cycles and macroeconomic trends

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Ronin in the Superchain Era: Interoperability and Liquidity

Joining the OP Stack-powered Superchain is a strategic move that gives Ronin access to Ethereum’s deepest liquidity pools and most active user base. This means assets, dApps, and users on Ronin can interact seamlessly with platforms like Base and Uniswap, unlocking new DeFi and NFT use cases that were previously siloed.

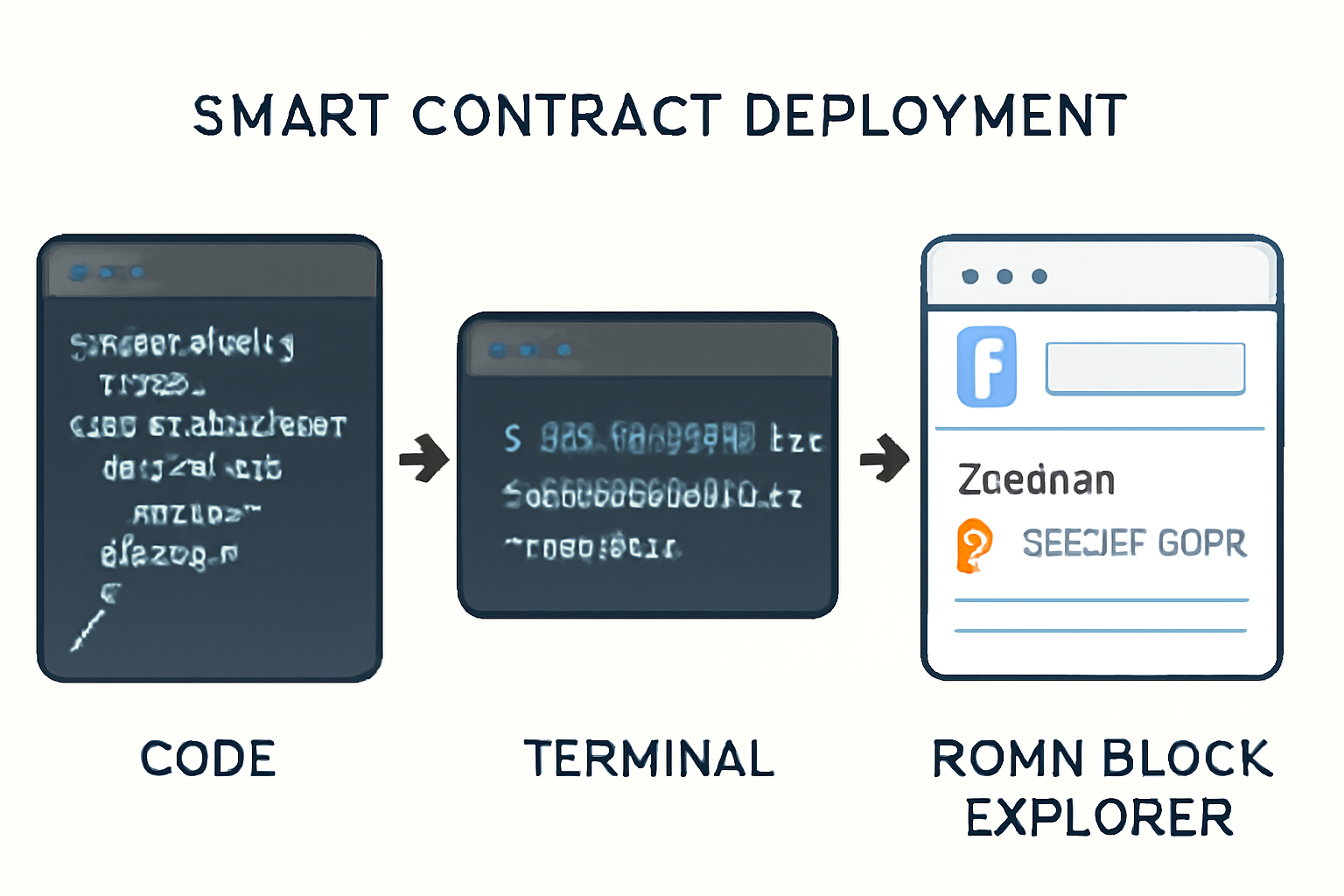

Developers migrating to Ronin’s OP Stack environment will find a dramatically improved toolkit for building scalable, composable dApps. With block times at 100-200 milliseconds and EigenDA ensuring high data throughput, Ronin is positioned to support real-time gaming, NFT marketplaces, and DeFi protocols operating at Web2 speeds. The network’s interoperability with the Superchain also means that liquidity, assets, and users can flow freely between Ronin, Base, and other OP Stack-powered chains.

This convergence of speed, security, and capital efficiency is particularly relevant for blockchain gaming. Millions of daily active users require near-instant settlement and low fees, precisely what Ronin now delivers. As a result, established studios and indie developers alike can launch games that rival traditional platforms in user experience, while leveraging the composability and ownership benefits of Web3.

Technical Impact: Finality, Security, and Cost Dynamics

Ronin’s technical leap is not just theoretical. The new L2 architecture delivers:

Key Technical Benefits of Ronin’s OP Stack & EigenDA Integration

-

Massive Transaction Throughput: Ronin’s integration with Optimism’s OP Stack and EigenDA enables up to 1 million transactions per second (TPS), supporting the scale required for millions of gamers and high-frequency blockchain applications.

-

Ultra-Fast Block Times: The OP Stack delivers block times between 100 and 200 milliseconds, resulting in near-instant transaction finality and a seamless user experience.

-

Ethereum-Grade Security: As an Ethereum Layer 2, Ronin inherits Ethereum’s robust security framework, significantly enhancing network resilience and user trust.

-

Enhanced Data Availability: EigenDA’s vertical scaling ensures transaction data remains accessible and verifiable, eliminating bottlenecks and supporting reliable network performance.

-

Developer Ecosystem & Incentives: Ronin developers gain access to Optimism’s $850M OP Retro Fund and up to $7 million in grants from partners like Eigen Labs and Boundless Foundation, accelerating innovation and growth.

-

Superchain Interoperability: Integration with the OP Stack connects Ronin to the Superchain ecosystem (including Base and Uniswap), enabling seamless asset and dApp interoperability across leading Ethereum L2s.

Finality times are slashed, enabling applications where latency is critical. The security model now inherits Ethereum’s robust consensus, reducing vulnerabilities common in sidechains. Meanwhile, EigenDA’s vertical scaling and data availability incentives ensure that transaction costs remain predictable and manageable, even at scale.

For the Ronin (RON) token, which is currently priced at $0.3818, this upgrade could catalyze renewed interest among investors and builders. The improved scalability and connectivity to the broader Ethereum ecosystem position RON as a utility token with expanding use cases across gaming and DeFi.

What’s Next for Ronin: Growth Catalysts and Community Impact

The next phase for Ronin focuses on onboarding new projects, expanding cross-chain bridges, and deepening integration with DeFi and NFT infrastructure. Initiatives like the Ronin Base bridge and Unichain integration will further enhance user and developer experience. Community-driven governance will play a critical role in setting protocol parameters and allocating ecosystem grants.

As these upgrades roll out, expect to see:

- Rapid onboarding of new gaming titles and NFT projects

- Cross-chain liquidity pools and advanced DeFi primitives

- Expanded support for on-chain analytics and developer tooling

In summary, Ronin’s integration with the OP Stack and EigenDA is more than a technical upgrade, it’s an ecosystem-wide transformation. The combination of ultra-fast finality, high throughput, and Ethereum-grade security sets a new bar for Layer 2 scalability. As Ronin (RON) holds at $0.3818, the network is poised to become a central hub for gaming, NFTs, and DeFi in the Superchain era.