In the ever-evolving world of blockchain scaling, Vitalik Buterin’s recent takedown of ‘copypasta’ EVM chains has sent shockwaves through the Layer 2 landscape. Calling out the flood of near-identical rollups as redundant, he argues Ethereum’s core upgrades will soon eclipse them in blockspace efficiency. Yet amid this critique, Ronin L2 rollups emerge not as another clone, but as a tailored powerhouse for high-throughput gaming, boasting up to one million transactions per second and sub-200ms block times. With RON trading at $0.1018 after a slight 24-hour dip of -0.0331%, Ronin’s pivot to an Ethereum-aligned L2 positions it ahead of the pack.

Vitalik’s Wake-Up Call: Why Copypasta L2s Are Losing Steam

Vitalik didn’t mince words on February 5,2026, via X: developers should ditch cookie-cutter EVM chains that fragment liquidity without fresh tech. Ethereum’s rollup-centric roadmap, he notes, assumed L2s as branded shards battling on cost alone. But with L1 fees plummeting and upgrades like Dencun slashing data costs, the excuse for generic rollups crumbles. Critics echo this, pointing to centralized governance in many big rollups that betray Ethereum’s ethos.

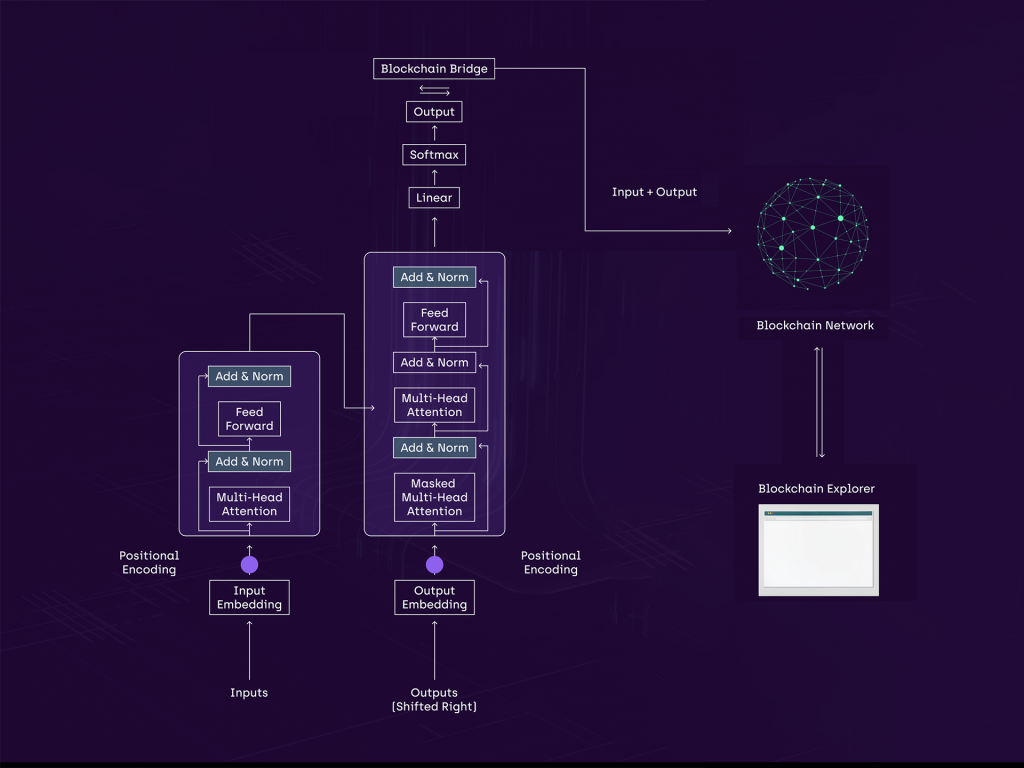

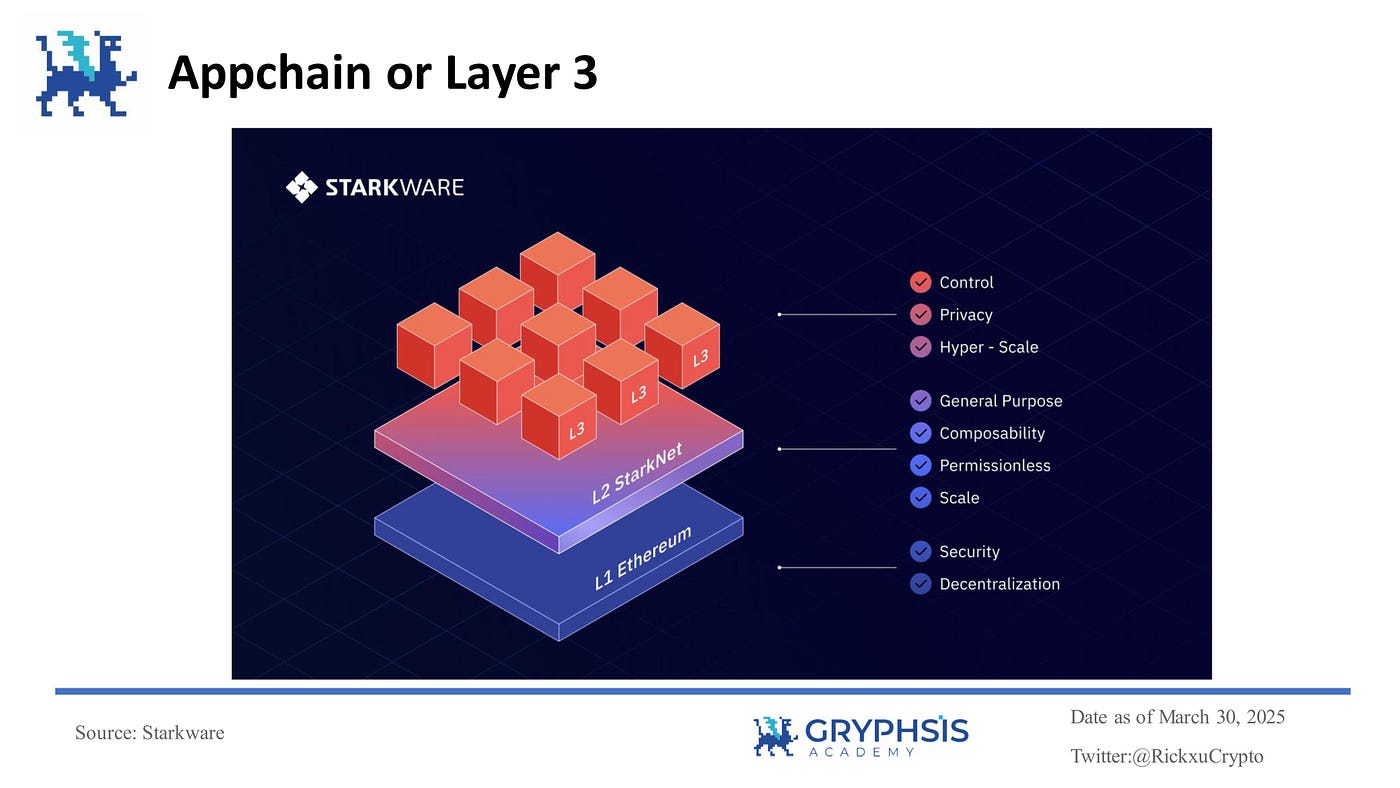

Enter Ronin vs copypasta L2s: while others copy-paste the OP Stack or Arbitrum orbit, Ronin integrates a modified Polygon CDK with ZK proofs. This isn’t replication; it’s reinvention for Web3 gaming’s demands, inheriting Ethereum security while slashing latency. No more stalling Ethereum’s vision, Ronin accelerates it.

Ronin’s L2 Migration: From Sidechain to Scalability Beast

Ronin’s announcement to transition from a standalone sidechain to a full Ethereum Layer 2 rollup flips the script on Vitalik’s Vitalik Ronin critique concerns. By leveraging Ethereum consensus, Ronin amps up security and taps into vast liquidity pools, all while targeting Ronin blockchain scalability 2026 milestones like 1M TPS. Block times? Down to 100-200ms, perfect for real-time gaming dApps where lag kills immersion.

This move addresses decentralization gripes head-on. Unlike copypasta chains with single sequencers, Ronin’s ZK-EVM hybrid distributes proof generation, edging toward Vitalik’s ideal of innovative, value-adding architectures. Developers get privacy boosts and ultra-low costs, making Ethereum L2 alternatives Ronin the smart play for gaming ecosystems.

Technical Edge: Sub-Second Finality That Copypasta Can’t Touch

Dive into the mechanics, and Ronin’s superiority shines. Traditional rollups batch transactions off-chain, posting to Ethereum L1 for settlement, but copypasta versions bottleneck on sequencer centralization. Ronin counters with a custom OP Stack tweak, achieving sub-second finality via optimistic execution fused with ZK validity proofs. Imagine confirming in-game trades instantly, no seven-day fraud windows.

For traders like me, spotting swing opportunities on Ronin means charting breakouts with confidence. At $0.1018, RON hovers near support after a 24h low of $0.1018, but L2 catalysts could ignite a rebound. Check the technical deep dive on sub-second finality for the full breakdown.

Ronin (RON) Price Prediction 2027-2032

Forecasts based on L2 rollup transition, gaming adoption, Ethereum alignment amid Vitalik’s copypasta chain critique; baseline 2026 price $0.1018

| Year | Minimum Price | Average Price | Maximum Price | Avg YoY % Change |

|---|---|---|---|---|

| 2027 | $0.35 | $0.95 | $2.10 | +834% |

| 2028 | $0.80 | $2.20 | $4.50 | +132% |

| 2029 | $1.50 | $3.80 | $7.00 | +73% |

| 2030 | $2.20 | $5.50 | $10.00 | +45% |

| 2031 | $3.00 | $7.50 | $13.50 | +36% |

| 2032 | $4.00 | $10.00 | $18.00 | +33% |

Price Prediction Summary

Ronin (RON) shows strong bullish potential from 2027-2032 due to its Ethereum L2 rollup migration, countering Vitalik Buterin’s critiques by offering innovative scalability (1M TPS, 100ms blocks) and ZK proofs for gaming. Average price could surge 100x to $10 by 2032 in adoption-driven bull scenarios, with mins reflecting bearish market cycles or delays.

Key Factors Affecting Ronin Price

- L2 rollup transition enhancing Ethereum security/composability

- Web3 gaming boom (Axie Infinity ecosystem growth)

- ZK proofs via Polygon CDK for privacy/scalability

- Crypto market cycles (post-2026 halving bull run)

- Regulatory tailwinds for blockchain gaming

- Competition risks from other L1/L2 gaming chains

- Ethereum base layer improvements reducing L2 fragmentation

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Gaming dApps on Ronin, from Pixels to emerging titles, already process millions of daily txns. This L2 upgrade scales that exponentially, drawing devs weary of Ethereum congestion. Vitalik wants new capabilities like privacy and latency wins? Ronin delivers, proving rollups evolve beyond copies.

Traders eyeing Ronin blockchain scalability 2026 should watch volume spikes on these upgrades. RON’s current $0.1018 price reflects a consolidation phase post-dip, with the 24h low matching spot at $0.1018 and high of $0.1076 signaling tight range action. A breakout above $0.1076 could target prior resistance, fueled by L2 hype.

Why Ronin crushes Vitalik’s ‘copypasta’ critique

| Metric | Ronin L2 ✅🚀 | Copypasta L2s ❌ |

|---|---|---|

| TPS | **1M TPS** ✅ | **10k-100k TPS** |

| Block Time | **Sub-second (100-200ms)** ✅ | **1-12s** |

| ZK Integration | **Full ZK accel via Polygon CDK** ✅ | **Basic/None** |

| Gaming Focus | **Gaming-optimized** 🎮✅ | **General-purpose** |

| Sequencer Bottlenecks | **Minimal** ✅ | **High sequencer issues** |

| RON Price | **$0.1018** 🚀 | **N/A** |

This isn’t hype; it’s engineered for gaming’s unique needs. Real-time PvP battles demand instant finality, which Ronin’s optimistic-ZK fusion provides. Copypasta chains fragment liquidity across silos; Ronin bridges seamlessly to Ethereum, pooling value where it counts.

For swing traders, Ronin’s chart patterns scream opportunity. Recent consolidation at $0.1018 mirrors classic flags before L2 announcements propelled 50% pumps. Pair classic TA with on-chain metrics like active wallets surging 20% weekly, and you’ve got conviction trades.

Ronin L2 Edges Over Copypasta

-

1M TPS: Supports up to 1 million transactions per second via Ethereum L2 rollup, far beyond copypasta limits.

-

Sub-200ms Blocks: Achieves 100-200ms block times for ultra-low latency, ideal for real-time apps.

-

ZK Privacy: Integrates zero-knowledge proofs with modified Polygon CDK for enhanced privacy and scalability.

-

Ethereum Security: Inherits Ethereum’s robust consensus, addressing Vitalik’s copypasta critiques on security.

-

Gaming-Optimized dApps: Tailored for blockchain gaming with low costs and high speeds on Ronin.

-

RON Resilience: RON price steady at $0.1018 (24h: -0.0331%), showing market durability.

What Vitalik’s Critique Means for InvestorsPositioning Ronin as the L2 Winner

Vitalik’s blast isn’t a death knell for rollups; it’s a filter for winners. He pushes for architectures adding new primitives, like privacy or latency breakthroughs. Ronin checks those boxes, evolving from sidechain isolation to Ethereum-aligned innovation. No copypasta here, just purpose-built scalability dodging the pitfalls he flags: centralization, liquidity splits, outdated tech.

At $0.1018, RON undervalues this pivot. Ethereum L1 fees crashing validate his point, but specialized L2s like Ronin thrive by carving niches. Gaming commands billions; Ronin captures it with low costs under $0.0001 per tx, drawing titles beyond Pixels. Investors ignoring this miss the next leg up.

Dive deeper into how Ronin solves core trilemma tensions in our guide on Ronin L2 rollups solving the blockchain scalability trilemma.

Gaming devs flock to Ronin for practical reasons: deploy EVM-compatible contracts with ZK privacy overlays, settle on Ethereum for trustlessness. This hybrid sidesteps copypasta sameness, offering ultra-low latency environments Vitalik craves. By 2026, expect Ronin dominating Web3 gaming TPS, with RON rewarding early positioners.

As a technical analyst, I blend these on-chain shifts with price action. RON’s 24h -0.0331% dip to $0.1018 tests support; volume rebound signals entry. Layer classic RSI divergences with L2 milestones for swings yielding 20-30% in weeks.

Ronin’s L2 ascent reframes Vitalik’s wake-up call as a green light for differentiated scalers. While copypasta fades, Ronin scales gaming frontiers, securing Ethereum’s multi-chain future on its terms.