As February 2026 unfolds, Ronin Network stands at the forefront of a liquidity renaissance in Web3 gaming, with trading volumes surpassing $1 million daily, fueled by its seamless integration as an Ethereum Layer 2 rollup using Optimism’s OP Stack. This isn’t mere hype; it’s the tangible outcome of a network now capable of processing up to one million transactions per second with block times of 100-200 milliseconds. At a current price of $0.1000, RON has seen a 24-hour change of and $0.000700 ( and 0.007100%), with a high of $0.1015 and low of $0.0986, underscoring steady momentum amid this surge in Ronin L2 rollups liquidity.

The shift from a standalone sidechain to this L2 architecture, completed in late 2025 ahead of schedule, aligns Ronin with Ethereum’s settlement layer while preserving RON as the native gas token. Developers and gamers alike benefit from inherited Ethereum security, deeper liquidity pools, and EVM compatibility that lowers barriers to entry. What began as a necessity for Axie Infinity has evolved into a robust ecosystem attracting diverse projects, where game assets now circulate fluidly across broader markets.

Ronin’s L2 Migration: A Blueprint for Blockchain Gaming Scalability

Ronin’s journey back to Ethereum, announced in August of the previous year and executed by Q1 2026, reflects a broader trend among gaming-focused chains seeking survival in a consolidating L2 landscape. Governing Validators approved the hardfork, integrating OP Stack to deliver sub-second finality and fees that are fractions of pre-migration levels. This upgrade addresses the data bottlenecks that once plagued high-volume gaming, enabling real-time interactions essential for immersive experiences.

Consider the technical leap: pre-L2 Ronin handled impressive loads for its era, but Ethereum’s congestion in 2021 necessitated independence. Now, as an optimistic rollup, it batches transactions off-chain for efficiency before settling on Ethereum, inheriting its economic security. This pivot enhances Ronin blockchain scalability gaming, drawing parallels to successes like Base, yet tailored for play-to-earn dynamics. The Ronin Treasury’s buyback program, converting ETH and USDC into RON, further tightens supply, amplifying value accrual as volumes climb.

“Becoming an L2 is a way for Ronin to inherit Ethereum’s security, liquidity and all the developer support that comes with it. ” – Castle Labs

Decoding the $1M and Trading Volumes: L2 Rollups as Liquidity Catalysts

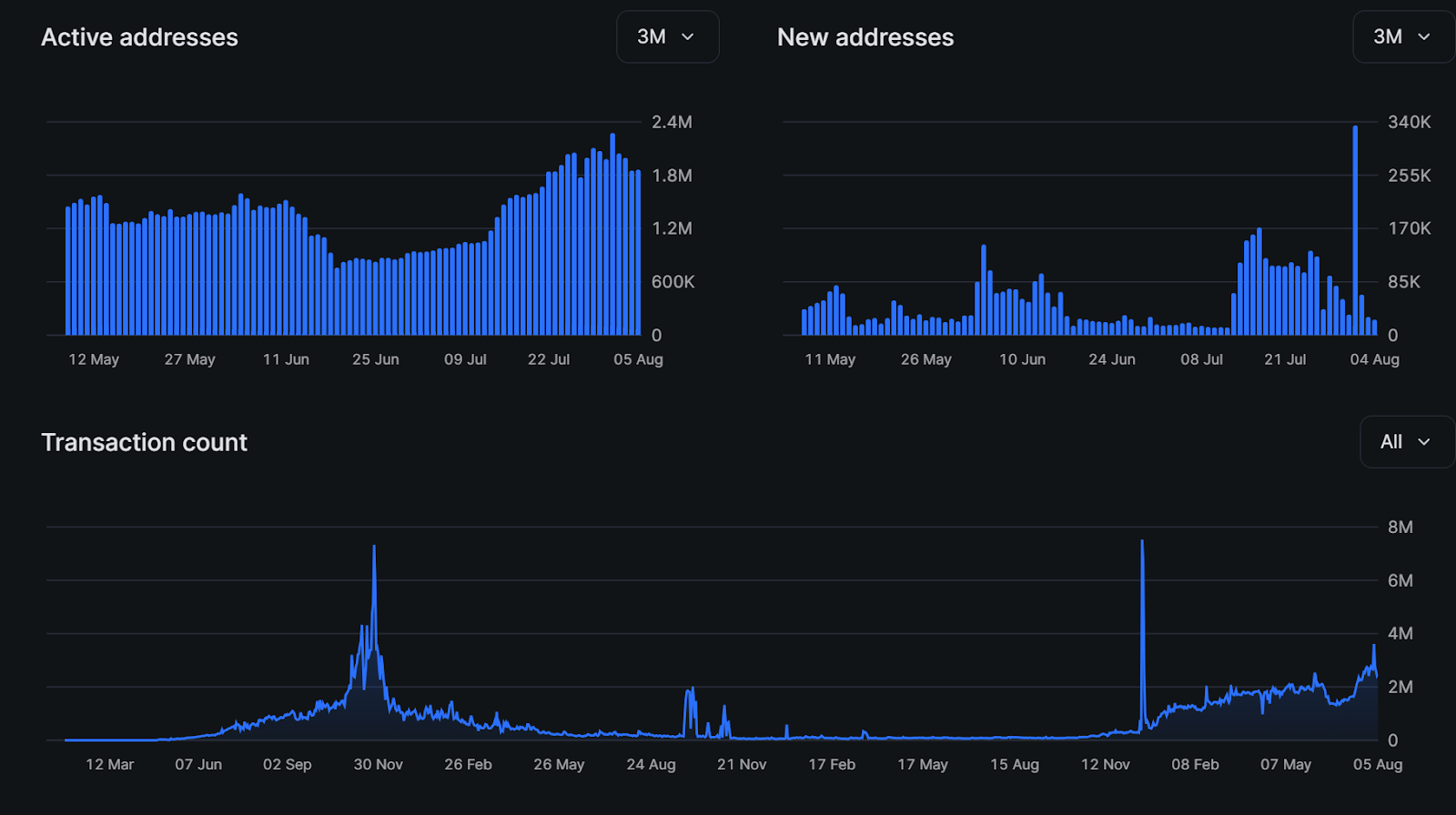

At the heart of Ronin Network trading volumes 2026 lies the L2 rollup’s ability to unlock latent demand. Post-migration, daily transactions spiked, active addresses grew, mirroring Ethereum’s own post-upgrade gains of 50% in volume and 60% in users. Ronin’s specialized focus on gaming amplifies this: NFT marketplaces, in-game economies, and DeFi primitives now thrive with liquidity depths unseen on sidechains.

Trading volumes exceeding $1 million aren’t isolated; they’re driven by ecosystem flywheels. Developers retain more through low costs, users engage longer due to speed, and liquidity providers capture yields from denser order books. This creates a virtuous cycle, where RON at $0.1000 serves as both utility and speculative asset. Yet, skeptics point to 21Shares’ forecast that most L2s may falter by year’s end; Ronin’s gaming niche and proven traction position it as an outlier.

One undeniable edge is asset interoperability. Game tokens and NFTs, once siloed, now tap Ethereum’s vast pools, boosting Ronin L2 rollups liquidity. Projects building on Ronin report 10x user retention, attributing it to seamless scaling that handles peak loads without hiccups.

Ronin (RON) Price Prediction 2027-2032

Post-L2 Migration Forecasts Amid Liquidity Surge and Web3 Gaming Growth (Conservative, Base, Optimistic Scenarios)

| Year | Minimum Price (Conservative) | Average Price (Base) | Maximum Price (Optimistic) |

|---|---|---|---|

| 2027 | $0.12 | $0.35 | $0.75 |

| 2028 | $0.22 | $0.65 | $1.50 |

| 2029 | $0.35 | $1.10 | $2.80 |

| 2030 | $0.55 | $1.60 | $4.00 |

| 2031 | $0.80 | $2.20 | $5.50 |

| 2032 | $1.10 | $2.80 | $7.50 |

Price Prediction Summary

Following the successful Ethereum L2 migration in 2026, RON is forecasted to experience substantial growth driven by enhanced scalability, token buybacks, and exploding Web3 gaming volumes. Base case projects an average price rise from $0.35 in 2027 to $2.80 by 2032 (700%+ cumulative growth), with optimistic scenarios reaching $7.50 amid bull market cycles and adoption surges.

Key Factors Affecting Ronin Price

- Ethereum L2 integration via OP Stack boosting TPS to 1M+ and attracting developers/gamers

- Ronin Treasury buybacks reducing circulating supply and supporting price floor

- Web3 gaming liquidity surge exceeding $1M daily volumes, expanding user base

- Market cycles with potential 2028-2029 bull run amplifying gaming token valuations

- Regulatory clarity for L2s and gaming assets enabling institutional inflows

- Competition from other L2s (e.g., Base) and gaming chains posing downside risks in conservative scenarios

- Technological upgrades like sub-200ms block times driving real-world adoption

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Web3 Gaming’s New Frontier: Retention and Innovation on Ronin Infrastructure

Web3 gaming L2 expansion Ronin is redefining onchain play. The network’s throughput supports complex mechanics like real-time PvP and dynamic economies, where thousands of concurrent users execute without lag. This has spurred a wave of migrations and new launches, from indie studios to AAA contenders leveraging Ronin’s transition to Ethereum L2.

Infrastructure builder retention is key here. Tools like OP Stack’s modular design allow customization, fostering loyalty among devs who once eyed competitors. Coupled with the treasury’s strategic buys, RON’s fundamentals strengthen, promising sustained Ronin infrastructure builder retention. As volumes hold above $1 million, the stage is set for exponential adoption, proving L2 rollups aren’t just scaling tech; they’re liquidity engines for gaming’s blockchain future.

Looking deeper, the metrics tell a compelling story: block times halved, TPS multiplied, and user growth accelerated. This positions Ronin not as a survivor, but a leader in an industry demanding reliability at scale.

Developers are flocking to Ronin precisely because it solves the execution bottlenecks that have long stifled onchain gaming ambitions. With L2 rollups compressing data availability costs and accelerating settlement, projects can now experiment with ambitious features like persistent worlds and guild-based economies without fearing network collapse. This isn’t speculation; it’s evidenced by the 10x retention rates reported across builder communities, where tools tailored for gaming keep talent from migrating elsewhere.

Ecosystem Flywheels: From Buybacks to Builder Loyalty

The Ronin Treasury’s buyback initiative, launched in late 2025, acts as a powerful stabilizer. By swapping ETH and USDC for RON at current levels around $0.1000, it methodically reduces circulating supply, countering dilution risks common in high-growth chains. This move, timed with the L2 activation, has correlated with the 24-hour uptick of and $0.000700 ( and 0.007100%), holding firm between a high of $0.1015 and low of $0.0986. Investors eyeing Ronin infrastructure builder retention appreciate this disciplined approach, which mirrors macro strategies in traditional assets: buy low, support fundamentals, let adoption compound returns.

Yet liquidity doesn’t manifest in a vacuum. Ronin’s OP Stack integration opens doors to Ethereum’s DeFi composability, allowing game tokens to collateralize loans or fuel yield farms seamlessly. This interoperability has supercharged Ronin L2 rollups liquidity, with order books on integrated DEXes thickening as arbitrageurs and hedgers pile in. Gaming studios benefit indirectly, as fluid markets price assets accurately, reducing slippage for in-game trades that once deterred casual players.

Navigating L2 Headwinds: Why Ronin Thrives Where Others Falter

Forecasts like 21Shares’ warning that most Ethereum L2s may not endure 2026 underscore the stakes. Fragmentation, sequencer centralization, and liquidity fragmentation doom generalists, but Ronin’s gaming specialization carves a defensible moat. Its pre-migration user base, honed by Axie Infinity’s trials, provides a ready liquidity pool that newcomers envy. Post-upgrade metrics bear this out: transaction volumes up 50%, active addresses surging 60%, echoing Ethereum’s own scaling triumphs but amplified for play-to-earn loops.

In my view, this positions Ronin as a bellwether for Web3 gaming L2 expansion Ronin. While broader L2s chase universal throughput, Ronin hones in on latency-sensitive use cases, delivering 100-200 millisecond blocks that enable true real-time competition. Developers retain infrastructure here because customization via OP Stack beats rigid alternatives, fostering a cycle of innovation and commitment.

Gaming projects migrating to Ronin cite these exact advantages, with one AAA contender reporting seamless handling of 50,000 concurrent sessions during beta. This scalability extends to emerging trends like social-fi integrations, where player-owned economies blend with social graphs for viral growth. As RON holds at $0.1000, buoyed by modest gains and robust fundamentals, the network’s trajectory suggests not just survival, but dominance.

The liquidity surge transcends numbers; it signals maturity. With Ethereum’s security blanket, Ronin bridges gaming’s mass appeal to blockchain’s rigor, ensuring assets retain value across sessions and seasons. For builders and investors, this L2 evolution isn’t a pit stop; it’s the foundation for Web3 gaming’s mainstream breakthrough, where Ronin Network trading volumes 2026 will only accelerate as adoption compounds.

Stakeholders should watch closely: treasury maneuvers, dev inflows, and volume persistence will dictate if Ronin redefines L2 viability. Early signs point unequivocally to yes, rewarding those who bet on gaming’s scalable future.