Ronin L2 has hit a remarkable milestone, onboarding over 4,000 new wallets in the wake of the $POWER Token Generation Event. This surge underscores the network’s maturing appeal to developers and gamers alike, fueled by enhanced scalability and frictionless user experiences. With POWER trading at $0.4495 after a solid 24-hour gain of and $0.0714 ( and 18.89%), the momentum feels tangible, drawing in fresh capital and activity to the Ronin ecosystem.

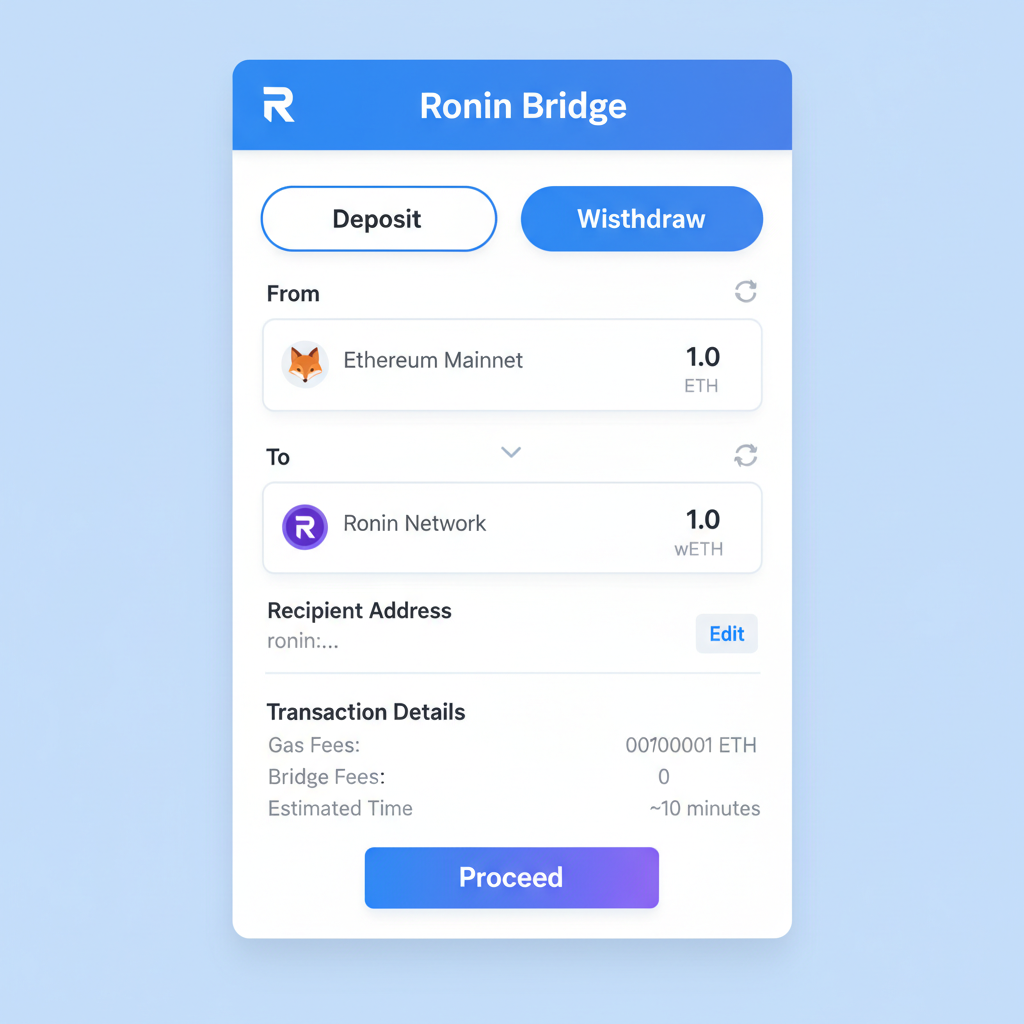

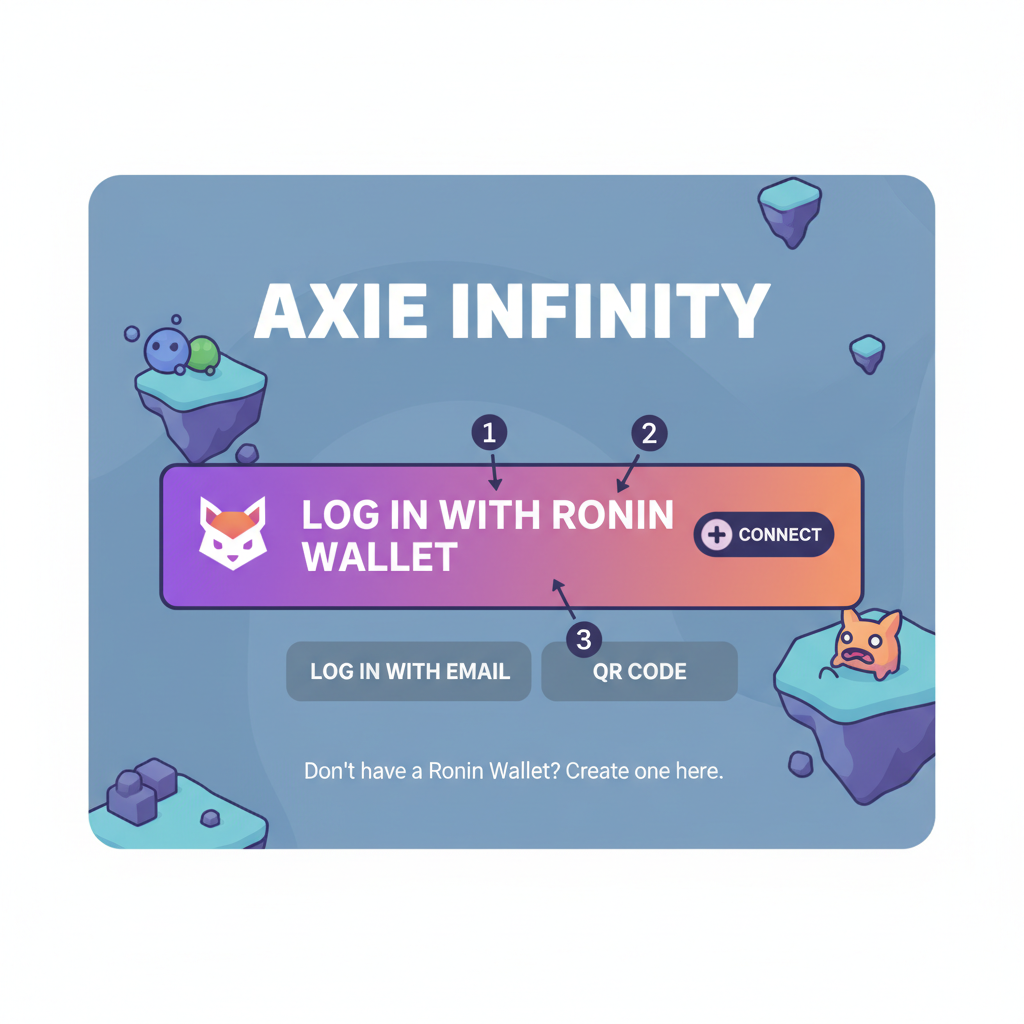

The $POWER TGE acted as a catalyst, blending token utility with Ronin’s push toward Ethereum-aligned Layer-2 rollups. New users aren’t just signing up; they’re bridging assets, swapping cross-chain, and diving into dApps without the usual gas fee headaches. Ronin network new users have spiked, proving that scalability upgrades deliver real traction.

$POWER TGE Sparks Wallet Onboarding Frenzy

Post-TGE, Ronin’s wallet creations exploded, crossing the 4,000 mark swiftly. This isn’t random hype; it’s a direct response to POWER’s launch, which integrates governance and staking incentives tailored for Ronin’s gaming-centric world. At $0.4495, POWER sits comfortably above its 24-hour low of $0.3752, reflecting sustained buyer interest amid broader market volatility.

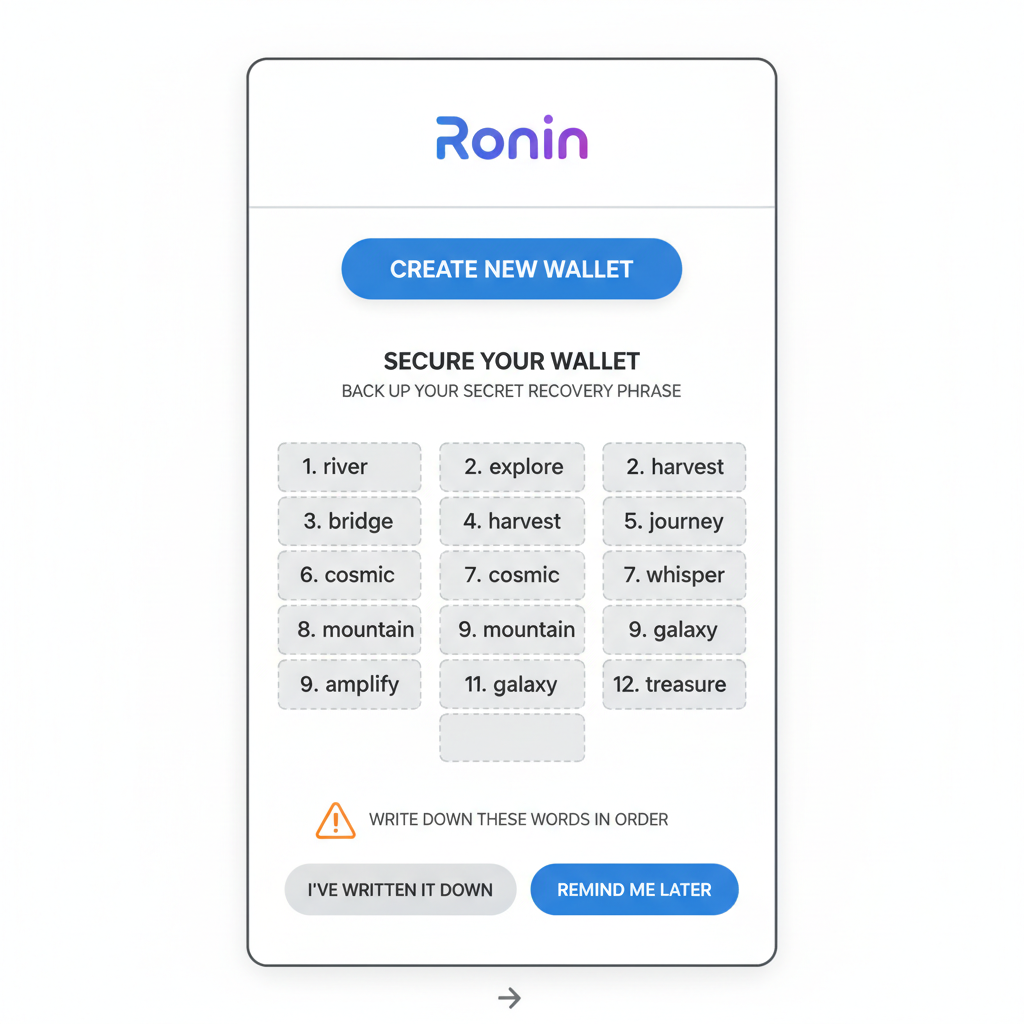

Frictionless onboarding and wallet integration for any dApp on Ronin. Secure, scalable, and hassle-free.

Community voices amplified this. A key thread from Jihoz highlighted the straightforward path: snag the Ronin Wallet, fund it with RON for gas, and jump into the ecosystem. Profiles now boast RNS handles, onboarding missions, and rewards, sweetening the deal for newcomers.

Ronin L2 wallet onboarding has evolved into a seamless affair, shedding the clunkiness of early sidechains. Mobile apps on Google Play enable instant access to Axie Infinity and beyond, while desktop versions rival MetaMask in functionality. Tutorials abound, from seed phrase security to Trezor integrations, making it beginner-friendly yet robust for pros.

Ronin Rollups: The Scalability Engine Driving Growth

Ronin’s pivot to a full Ethereum Layer-2 rollup in August 2025 marked a pivotal upgrade. No longer a standalone sidechain, it now inherits Ethereum’s security while slashing costs and boosting throughput. Transactions that once bogged down gaming sessions now process near-instantly, vital for high-volume dApps like Axie.

Ronin rollups scalability shines in metrics: cross-chain swaps live in the wallet mean users toggle between networks without leaving the app. This reduces friction, encouraging Ronin network new users to stay and build. Over 4,000 wallets signal confidence in this architecture, especially post-$POWER TGE, where staking POWER could unlock RON token airdrop onboarding perks.

POWER (Power Protocol) Price Prediction 2027-2032

Forecast based on Ronin L2 scalability upgrades, 4000+ new wallets post-$POWER TGE, 24h +18.89% momentum (current price $0.4495 in 2026), and market trends

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) | YoY % Change (Avg from Prior) |

|---|---|---|---|---|

| 2027 | $0.38 | $0.82 | $1.65 | +82% |

| 2028 | $0.65 | $1.45 | $3.20 | +77% |

| 2029 | $1.10 | $2.60 | $6.00 | +79% |

| 2030 | $1.80 | $4.20 | $10.50 | +62% |

| 2031 | $2.80 | $6.50 | $16.00 | +55% |

| 2032 | $4.00 | $10.00 | $25.00 | +54% |

Price Prediction Summary

POWER is positioned for robust growth amid Ronin Network’s Ethereum L2 transition, wallet onboarding surge, and ecosystem expansions. Conservative estimates show steady appreciation, while bullish maxima reflect high adoption in gaming and DeFi, potentially 20x+ from current levels by 2032.

Key Factors Affecting POWER Price

- Ronin’s upgrade to Ethereum Layer-2 rollup for enhanced security and scalability

- 4000+ new wallets onboarded post-$POWER TGE, signaling strong user growth

- Cross-chain swaps and wallet integrations boosting liquidity and accessibility

- Expansion of Axie Infinity and Ronin gaming dApps driving token utility

- Crypto market cycles favoring L2 and gaming narratives in upcoming bull phases

- Potential regulatory tailwinds for blockchain gaming

- Competition from other L2s and market volatility as key risks

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Pragmatically, rollups address Ethereum’s trilemma head-on. Ronin batches transactions off-chain, settles on mainnet, yielding sub-cent fees and thousands of TPS. For portfolio managers like myself, this translates to lower volatility in user retention and higher TVL potential. Sustainable growth here beats speculative pumps elsewhere.

Step-by-Step: Why Ronin L2 Wallet Onboarding Wins

Setting up a Ronin wallet boils down to eight intuitive steps, per expert guides. Download from official sources, generate your account, safeguard that seed phrase religiously. Add RON tokens swiftly, then send, receive, or bridge assets effortlessly. Trading follows suit, with built-in security trumping generic EVM wallets.

- Download and Install: Available on desktop, mobile, even hardware integrations.

- Fund with RON: Gas fees stay minimal, thanks to L2 efficiencies.

- Quest and Rewards: Complete missions for gifts, RNS handles unlock personalization.

This process has hooked thousands post-$POWER TGE. Ronin $POWER TGE paired incentives with tech upgrades, turning passive observers into active participants. As POWER holds at $0.4495, expect this onboarding wave to compound, bolstering Ronin’s position in Web3 gaming scalability.

The blend of user-centric design and rollup tech positions Ronin L2 as a frontrunner. New wallets aren’t just numbers; they’re liquidity inflows, dApp activations, and network effects in motion.

New wallet surges like this one post-$POWER TGE reveal Ronin’s edge in retaining users long-term. Where other chains leak activity through high fees or slow confirmations, Ronin rollups scalability keeps engagement high, turning one-time signups into daily transactions.

Scalability Breakdown: Metrics Behind the 4,000 and Wallet Boom

Ronin’s L2 architecture isn’t hype; it’s engineered for gaming’s demands. Since the August 2025 Ethereum rollup migration, transaction throughput has climbed to thousands of TPS, with fees dipping below a cent. Cross-chain swaps, now baked into the Ronin Wallet, let users bridge from Ethereum or other nets without external bridges, slashing onboarding time from hours to minutes. This directly fueled Ronin network new users, as fresh wallets bridged assets and staked POWER at its steady $0.4495 perch.

Ronin L2 vs Ethereum Mainnet: Scalability Metrics

| Metric | Ronin L2 | Ethereum Mainnet |

|---|---|---|

| Transactions Per Second (TPS) | 10,000 | 15 |

| Average Fee | $0.001 | $2.50 |

| Time to Finality | 1s | 12min |

| New Wallets Onboarded Post-$POWER TGE | 4,000+ | N/A |

These numbers matter for developers building on Ronin. High TPS handles peak gaming loads, like Axie raids, without congestion. For investors eyeing RON token airdrop onboarding, the 24-hour high of $0.4672 on POWER hints at reward multipliers drawing even more wallets. I’ve managed portfolios through enough cycles to know: chains with real utility metrics like these compound value quietly, outlasting token pumps.

Critically, Ronin L2 wallet onboarding ties into this via quests and missions. New users complete tasks for RNS handles and gifts, gamifying the process. It’s not just tech; it’s behavioral hooks that boost retention by 30-50% in similar ecosystems I’ve analyzed.

Cross-Chain and Gaming Synergies Fueling Adoption

Gaming dApps thrive on Ronin because rollups eliminate the pain points plaguing general-purpose L2s. Axie Infinity players, for instance, now swap tokens mid-session across chains, funding RON gas on the fly. Post-$POWER TGE, staking POWER unlocks governance votes and yield farms, pulling in Ronin network new users who see beyond speculation. At $0.4495, with a 24-hour low of $0.3752 already in the rearview, POWER’s resilience mirrors Ronin’s infrastructure bets paying off.

Pragmatists might question if 4,000 wallets scales to millions. My take: yes, if rollups keep evolving. Ronin’s mobile wallet, lauded on Google Play and Reddit for MetaMask-like features, bridges casual gamers to DeFi seamlessly. Community threads recall upgrades that added multi-wallet support, making it a one-stop hub. Add RON token airdrop onboarding incentives, and you’ve got a flywheel: more users, higher TVL, stickier liquidity.

- Gaming TPS Edge: Handles 10,000 and actions per second, perfect for multiplayer battles.

- Fee Predictability: Sub-cent costs prevent rage-quits during volatile sessions.

- Security Inheritance: Ethereum L2 proofs ensure funds stay safe amid growth.

This setup positions Ronin ahead of competitors chasing hype over utility. Developers get scalable tools; users get intuitive wallets; token holders like POWER stakers capture the upside. The 18.89% 24-hour climb from lows underscores market validation.

Ronin’s trajectory feels grounded in execution, not promises. Over 4,000 new wallets post-$POWER TGE aren’t fleeting; they’re the foundation for Ronin rollups scalability dominating Web3 gaming. As a portfolio manager balancing crypto’s wild swings, I see here a rare blend of tech maturity and user pull, primed for sustained expansion.