The explosive growth of Layer 2 (L2) solutions has redefined Ethereum’s scalability landscape, but it has also brought new risks to the forefront, especially when it comes to sequencer centralization. As Ronin L2 continues its expansion, understanding how sequencer risk mitigation shapes the protocol’s security and decentralization is crucial for developers, validators, and anyone invested in Web3 infrastructure.

Why Sequencer Centralization Is a Critical Issue

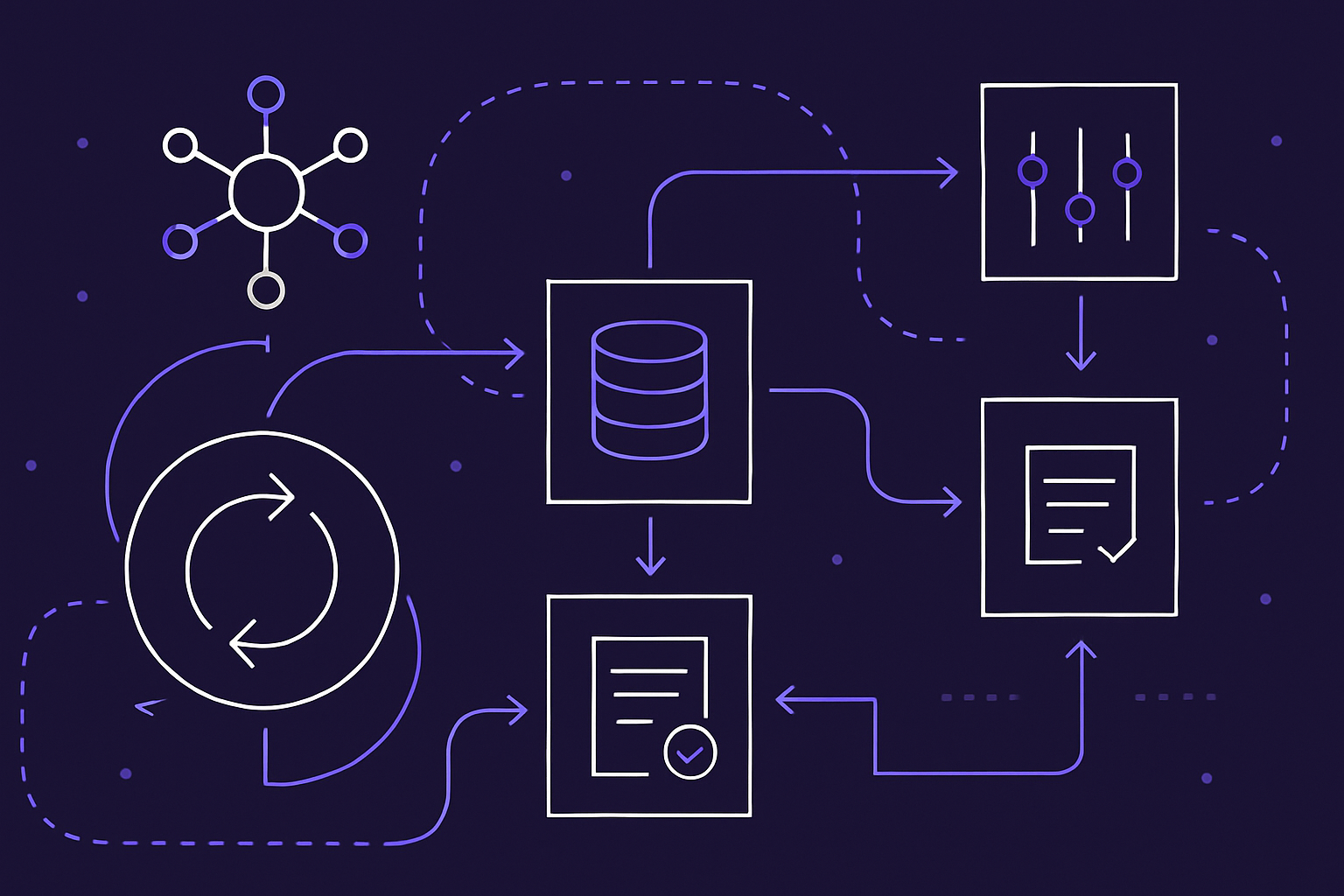

Sequencers are the beating heart of most L2 networks. They order transactions, create blocks, and determine what gets included in the chain. However, placing too much power in the hands of a single sequencer or a small group can introduce significant risks:

- Censorship: A centralized sequencer could refuse to include certain transactions or addresses.

- Order Manipulation: With unilateral control over transaction order, sequencers could exploit MEV (Maximal Extractable Value) opportunities at users’ expense.

- Single Point of Failure: Outages or attacks on a centralized sequencer can halt an entire L2 network.

This is not just theoretical. The crypto community is increasingly vocal about these issues, as highlighted in recent research and social commentary:

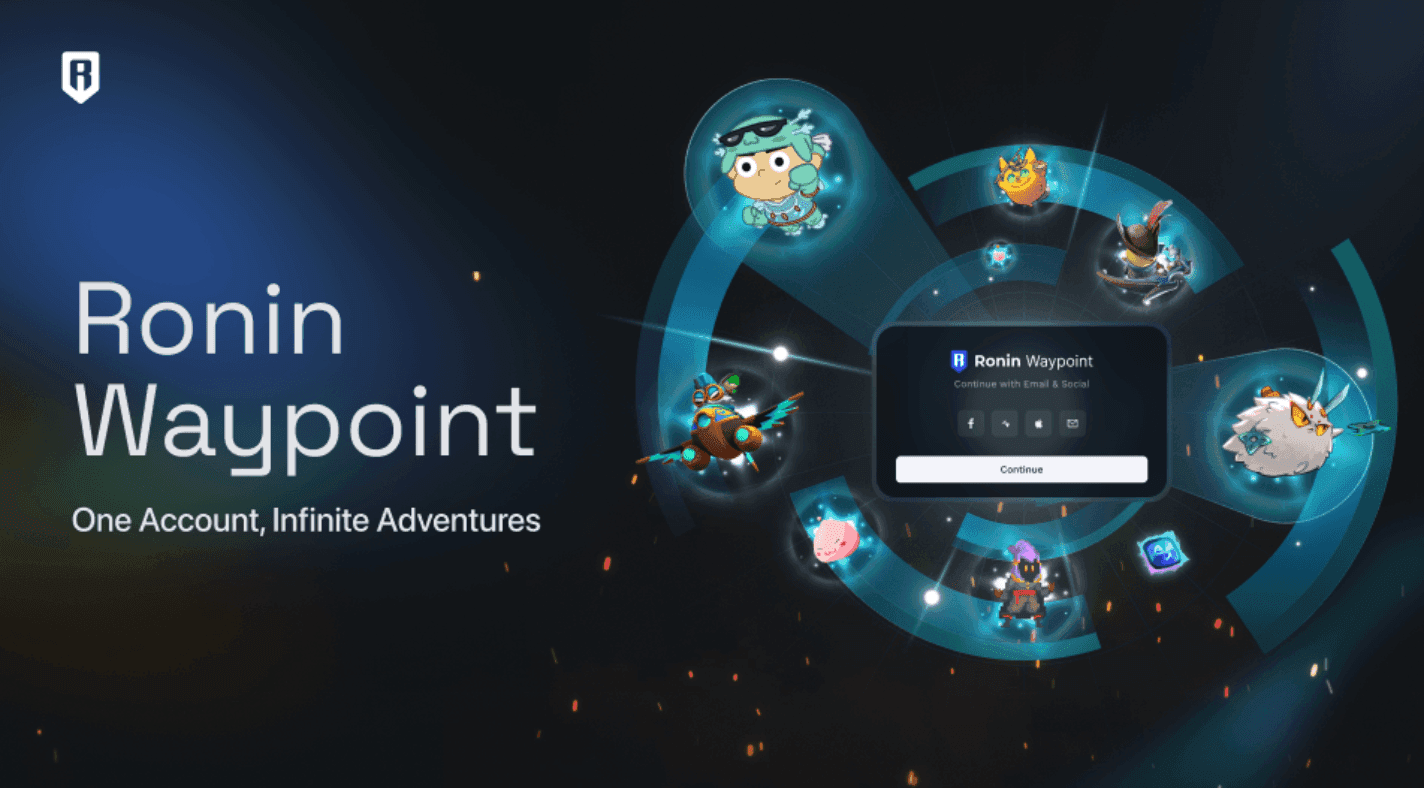

Ronin L2 Sequencer: From Proof of Authority to Decentralized Validation

Ronin’s journey offers a compelling case study in L2 sequencer security. Initially built as a Proof of Authority (PoA) sidechain for Axie Infinity, Ronin faced criticism for its limited validator set and associated centralization risks, concerns that were spotlighted after the March 2022 bridge breach. In response, Ronin transitioned to a Delegated Proof of Stake (DPoS) mechanism in April 2023. The updated structure features:

- 12 Governing Validators, elected by RON token holders

- 10 Rotating Validators, randomly selected each epoch based on staked amounts

- A total of 22 active validators per epoch, distributing block production responsibilities more widely

This hybrid model aims to dilute control over transaction sequencing while maximizing both performance and security. By granting the community direct influence over validator selection, and introducing randomness into validator rotation, Ronin has taken concrete steps toward mitigating centralization risk.

How Does This Compare to Other Ethereum L2s?

The majority of Ethereum rollups today rely on either a single operator or a tightly controlled multisig for sequencing, an arrangement that critics argue is antithetical to blockchain’s core ethos. In contrast, Ronin’s evolving approach provides increased transparency and broader participation without sacrificing speed or user experience. As highlighted by industry analysts, this positions Ronin as an example for other appchains seeking full sovereignty while retaining robust security measures (source).

Current Market Context: RON Price and Ecosystem Developments

Ronin (RON) Price Prediction 2026-2031

Comprehensive price outlook for Ronin (RON) based on current market data, technology improvements, and evolving market trends. All prices are in USD.

| Year | Minimum Price | Average Price | Maximum Price | Expected % Change (avg) | Market Scenario Notes |

|---|---|---|---|---|---|

| 2026 | $0.41 | $0.57 | $0.84 | +16% | Adoption as Ethereum L2 gains traction, but L2 competition remains fierce; security upgrades support moderate growth. |

| 2027 | $0.49 | $0.69 | $1.09 | +21% | Broader adoption of Axie ecosystem and Ronin’s improved decentralization; potential regulatory headwinds could cause volatility. |

| 2028 | $0.61 | $0.85 | $1.32 | +23% | L2 sector matures, Ronin benefits from cross-chain interoperability and gaming sector recovery; bullish scenario if gaming NFTs rebound. |

| 2029 | $0.75 | $1.04 | $1.60 | +22% | Ronin’s tech stack and validator model recognized as industry standard; continued growth if Ethereum L2s remain in demand. |

| 2030 | $0.93 | $1.29 | $2.00 | +24% | Strong institutional interest in L2s; Ronin’s ecosystem expansion and new partnerships drive value, but macro risks persist. |

| 2031 | $1.10 | $1.57 | $2.45 | +22% | Ronin establishes itself as a leading gaming L2; increased adoption and utility, but faces competition from new L2 entrants. |

Price Prediction Summary

Ronin (RON) is projected to see steady growth from 2026 through 2031, building on its transition to Ethereum L2, enhanced decentralization, and ongoing adoption in the gaming sector. Prices are expected to trend upward, but volatility will remain due to competition and broader market cycles. The average price is forecasted to nearly triple over the period if Ronin maintains its technological edge and attracts continued adoption.

Key Factors Affecting Ronin Price

- Adoption of Ethereum L2 and Ronin’s role in gaming and NFT ecosystems.

- Implementation and perceived effectiveness of decentralization and security upgrades (e.g., DPoS, Chainlink CCIP).

- Overall crypto market cycles and risk appetite, especially for L2 tokens.

- Regulatory developments impacting Ethereum, L2s, and gaming tokens.

- Competition from other L2 solutions and emerging blockchain technologies.

- Potential for new partnerships, integrations, and ecosystem expansion.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The current price of Ronin (RON) stands at $0.4934, with recent fluctuations reflecting ongoing upgrades and governance changes across the network. This price stability comes despite broader market volatility, a testament to growing confidence in Ronin’s security architecture and decentralized roadmap.

The Role of Secure Bridges and Interoperability Protocols

No discussion about L2 security would be complete without mentioning cross-chain bridges, a notorious attack vector in DeFi history. Learning from past breaches, Ronin integrated Chainlink’s Cross-Chain Interoperability Protocol (CCIP) in late 2024 (source). This move not only enhances bridge security but also aligns with Ronin’s broader commitment to decentralization through standardized threat inspection across networks.

These technical and governance upgrades are more than just incremental improvements. They represent a strategic shift in how Ronin L2 addresses the endemic risks of sequencer centralization that plague many Ethereum Layer 2s. By embedding randomness, community governance, and robust interoperability into its protocol, Ronin is actively working to make censorship, order manipulation, and single-point-of-failure scenarios far less likely.

Pros and Cons: Ronin L2 Sequencer Approach

Comparison of Ronin’s Decentralized Sequencer Model vs. Centralized Sequencers in L2 Networks

| Aspect | Ronin’s Decentralized Sequencer Model | Traditional Centralized Sequencers |

|---|---|---|

| Censorship Resistance | High: Multiple validators and random selection reduce risk of censorship. | Low: Single sequencer can censor or reorder transactions. |

| Security | Enhanced: Uses DPoS with 22 validators per epoch and Chainlink CCIP for bridge security. | Vulnerable: Single point of failure increases risk of hacks and manipulation. |

| Decentralization | Strong: Community-elected and rotating validators distribute control. | Weak: Centralized control undermines blockchain principles. |

| Scalability & Performance | High: Claims up to 12x faster transaction speeds and lower gas fees. | High, but at the cost of centralization and potential bottlenecks. |

| Resilience to Attacks | Improved: Distributed validator set and secure interoperability reduce attack surface. | Poor: Centralized sequencer is an attractive target for attackers. |

| Governance | Community-driven: Token holders delegate to validators, promoting transparency. | Opaque: Decisions are made by a single entity or small group. |

| Flexibility | Full sovereignty over tech stack and order flow. | Limited: Dependent on sequencer operator’s decisions. |

| Current Market Data (RON) | RON price: $0.4934 (24h change: -0.0258%) | N/A |

While no system is without trade-offs, Ronin’s design choices offer a pragmatic path forward for appchains seeking both performance and resilience. The increased validator count and rotating selection mechanism create a more dynamic environment where collusion is harder to achieve, yet transaction throughput remains high, crucial for gaming ecosystems like Axie Infinity.

Top Benefits of Ronin’s DPoS Sequencer Model

-

Decentralized Sequencer Control: Ronin’s DPoS system empowers the community by allowing token holders to delegate their stakes to Governing and Rotating Validators, reducing the risk of a single point of failure.

-

Enhanced Censorship Resistance: By rotating 10 out of 22 validators each epoch and electing 12 through community vote, Ronin makes it much harder for any single entity to censor transactions or manipulate order flow.

-

Community Governance: Token holders actively participate in network security and governance, ensuring that the sequencer set reflects the interests of the broader Ronin community.

-

Improved Security via Chainlink CCIP: Integration with Chainlink’s Cross-Chain Interoperability Protocol (CCIP) in late 2024 enhances bridge security and provides a standardized framework for secure cross-chain operations.

-

Fast and Affordable Transactions: As an Ethereum L2, Ronin offers up to 12x faster transaction speeds and lower gas fees compared to Ethereum mainnet, making it ideal for users and developers.

-

Full Tech Stack Sovereignty: Ronin maintains control over its own order flow, fee logic, and transaction inclusion, allowing for tailored optimizations without sacrificing security.

At the same time, community involvement in validator elections means that token holders have a direct stake in network security. This participatory approach not only strengthens decentralization but also incentivizes good behavior among validators. As staking participation grows, so does the network’s resistance to malicious actors or coordinated attacks.

Future Outlook: Scaling Without Sacrificing Security

The landscape of Ethereum rollups is evolving rapidly. Centralized sequencers may offer short-term convenience, but as user bases expand and DeFi capital inflows accelerate, the long-term risks become untenable. With its recent migration to Chainlink CCIP and ongoing validator set expansion, Ronin is signaling that robust risk mitigation isn’t just a marketing point, it’s foundational to sustainable growth.

The current RON price of $0.4934 reflects market recognition of these improvements, even as other L2 tokens experience sharper volatility swings. As new governance proposals are debated and implemented on-chain, expect further enhancements aimed at making sequencer operations even more transparent and tamper-resistant.

“Decentralization isn’t just about spreading out nodes, it’s about empowering communities to shape their own security guarantees. “

For developers building on Ronin or evaluating L2 options for their dApps, understanding these architectural choices is critical. Sequencer risk mitigation isn’t an abstract concern, it directly impacts uptime guarantees, censorship resistance, and user trust. As more projects demand sovereignty over their tech stacks without compromising on Ethereum-level security standards, models like Ronin’s will likely become industry benchmarks.