Ronin Network is at the epicenter of a major architectural evolution, pivoting from its origins as a dedicated gaming sidechain to a sophisticated hybrid Layer 1 and Layer 2 solution. As of September 2025, this transformation is reshaping how sovereign chains connect to Ethereum, directly impacting scalability, interoperability, and the broader Web3 gaming ecosystem. The move comes as Ethereum itself has improved scalability and cost efficiency, with ETH currently trading at $3,980.50 after a recent dip of 4.80% in the past 24 hours.

From Sidechain to Hybrid Architecture: Why Ronin Rejoins Ethereum

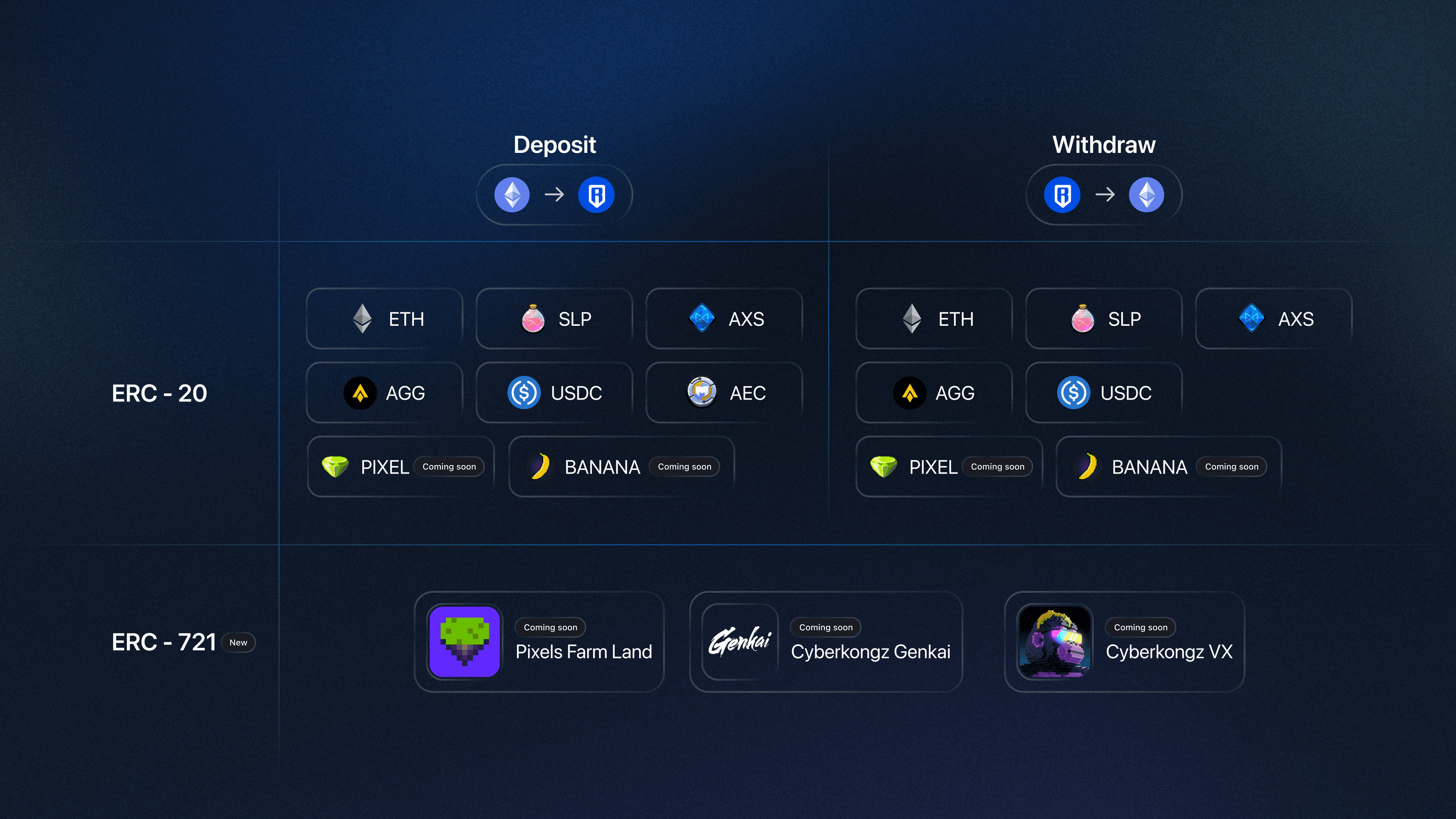

Launched in 2021 to support Axie Infinity’s explosive growth, Ronin Network originally addressed Ethereum’s congestion and high transaction fees by operating as an independent Layer 1 sidechain. This approach allowed for rapid transactions and low costs, crucial for play-to-earn mechanics and NFT transfers. However, as Ethereum’s rollup-centric roadmap matured and gas fees stabilized near all-time lows, the rationale for isolated sidechains began to erode.

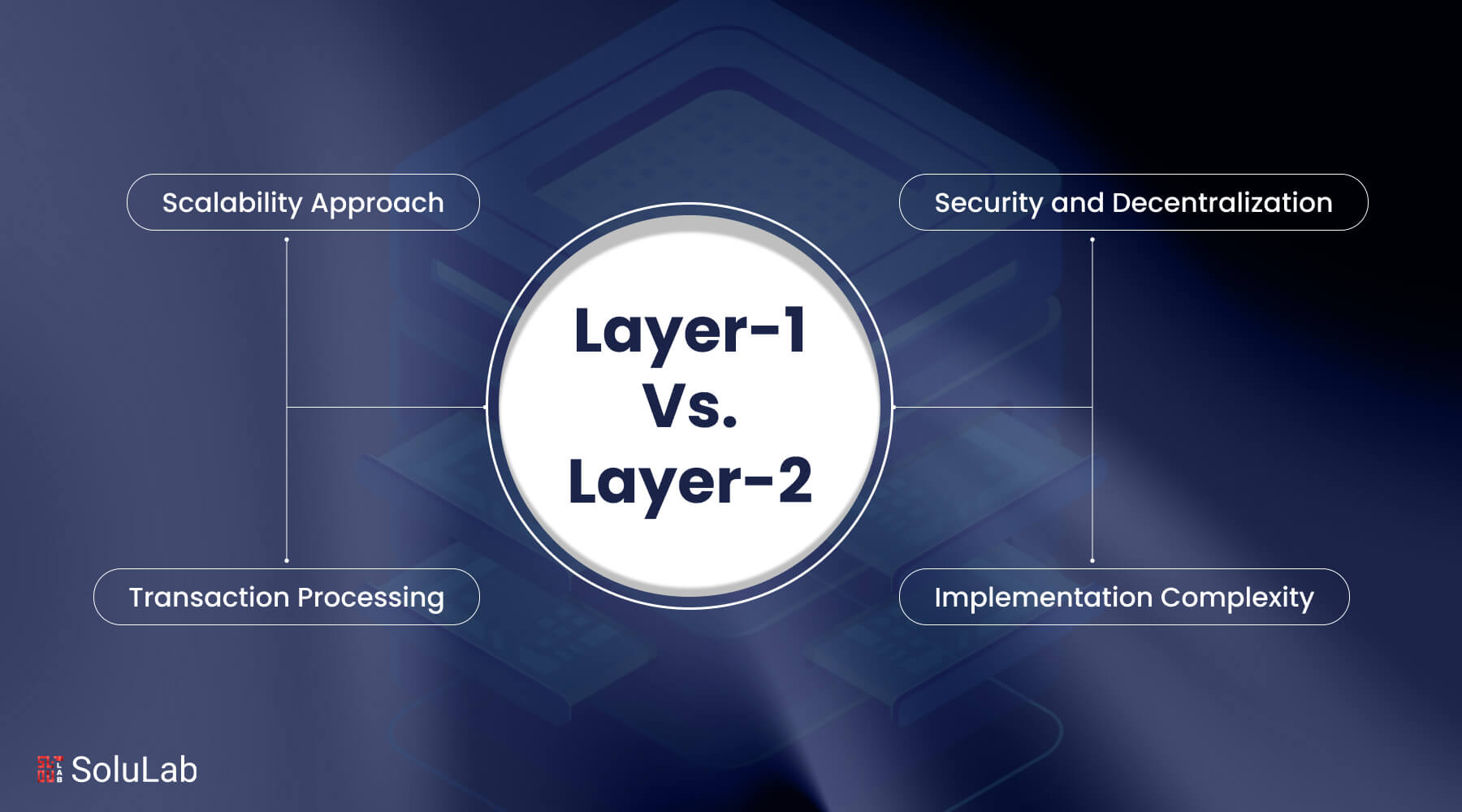

Ronin’s transition back to Ethereum represents more than just technical alignment; it’s a strategic recalibration designed to harness Ethereum’s security guarantees while preserving Ronin’s sovereignty through native gas tokenomics (RON). Unlike other rollups that default to ETH for transaction fees, Ronin will continue utilizing RON, maintaining continuity for existing users while integrating with Ethereum settlement. This duality exemplifies the Ronin Network hybrid architecture: an L2 rollup inheriting security from Ethereum but retaining L1-like autonomy in economics and governance.

The Mechanics of Sovereign Blockchain Interoperability

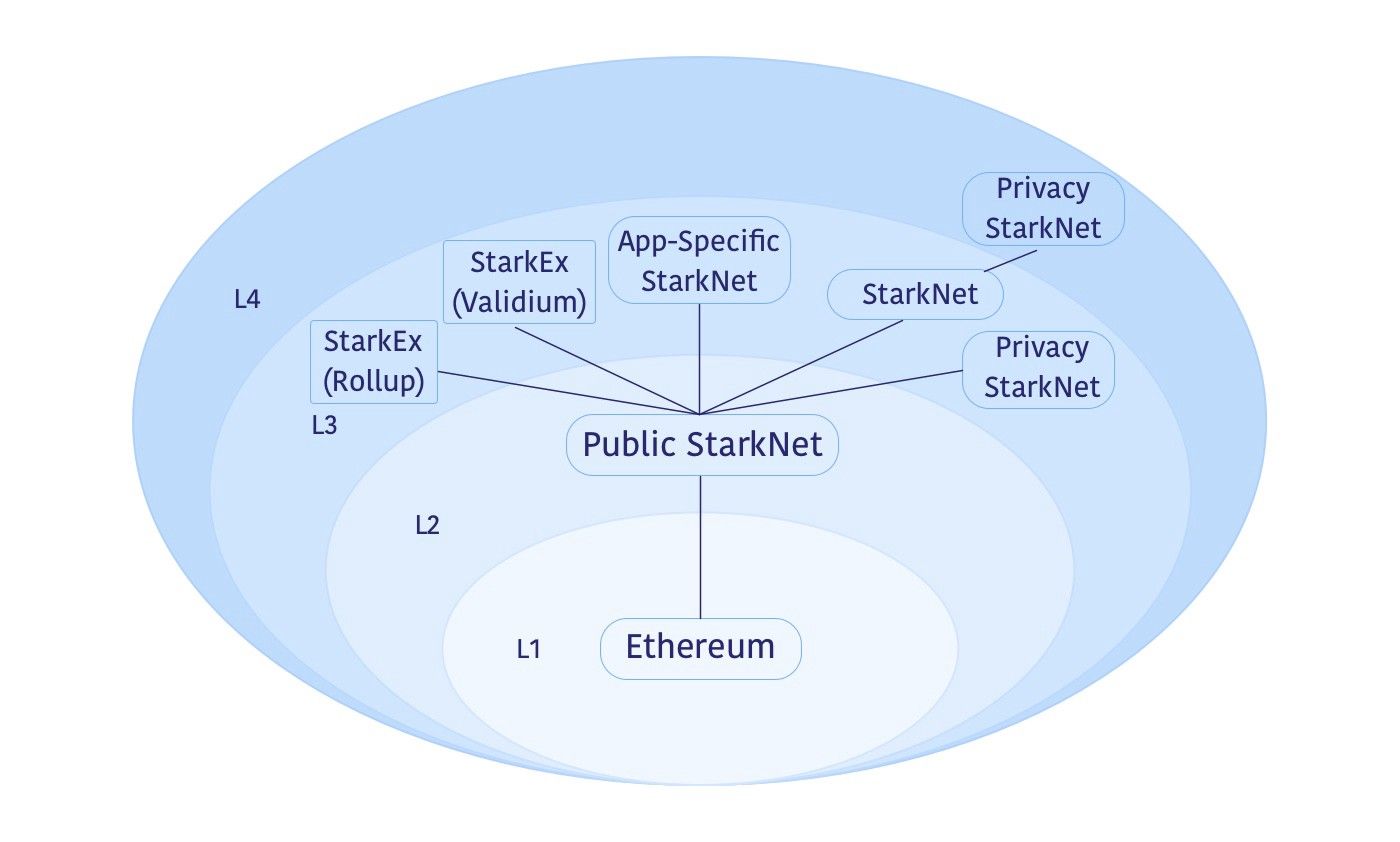

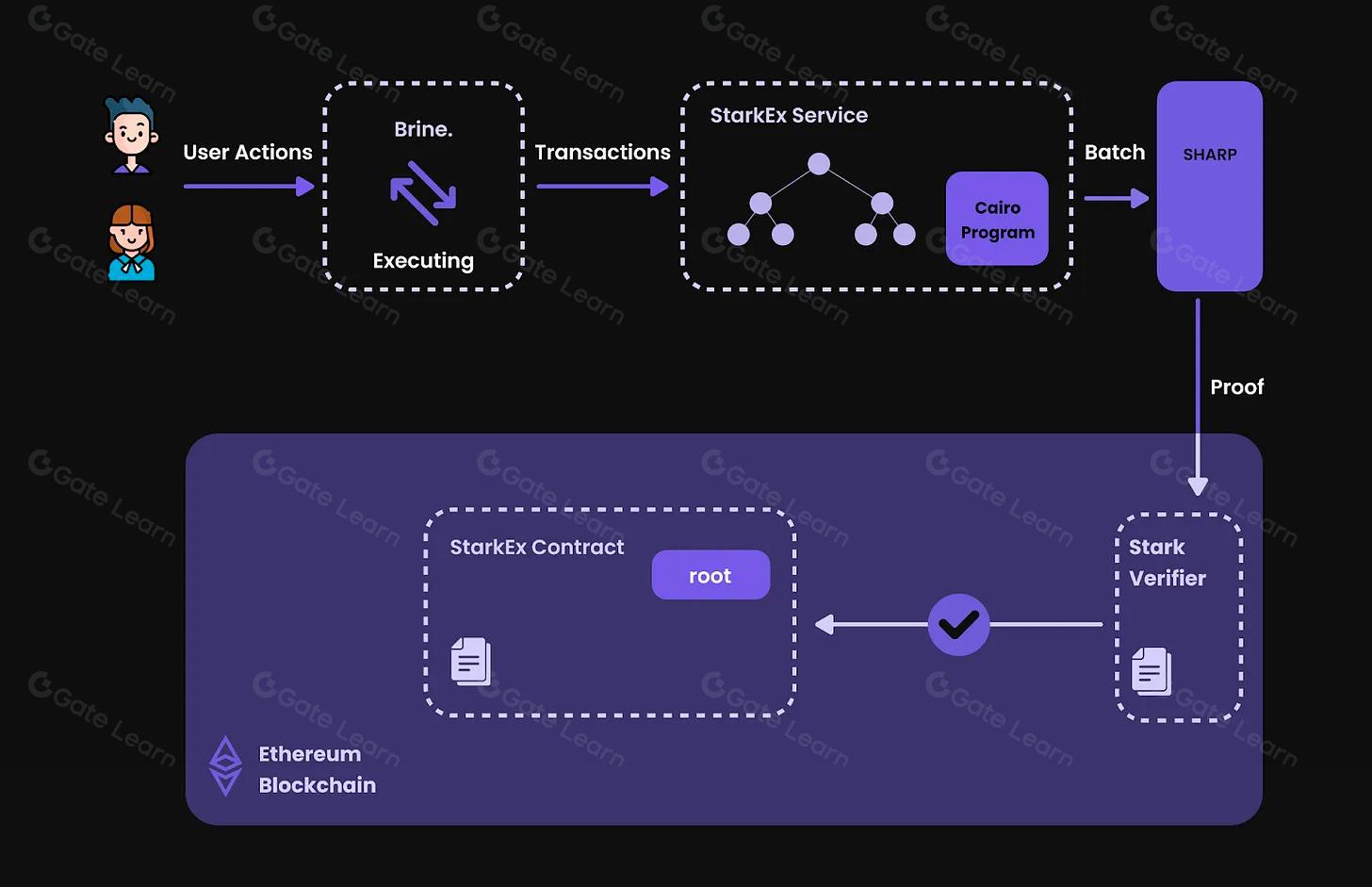

This hybrid model is powered by advanced rollup scaling strategies, specifically zero-knowledge EVMs (zkEVMs): that allow developers to deploy their own customizable Layer 2 chains atop the Ronin mainnet. Each of these sovereign chains posts transaction data back to Ethereum for final settlement, leveraging both speed and trustlessness without sacrificing customizability or performance.

According to official Ronin documentation, this approach opens new frontiers for dApp developers targeting high-throughput applications such as Web3 gaming or DeFi protocols. For users, it translates into lower fees, faster confirmation times, and seamless access to a wider universe of interoperable dApps, all underpinned by Ethereum’s battle-tested security model.

Key Benefits of Ronin’s Hybrid Layer 1 & Layer 2 Architecture

-

Enhanced Security via Ethereum Settlement: By transitioning to a Layer 2 rollup model, Ronin leverages Ethereum’s robust security guarantees, inheriting the protection of the mainnet while maintaining its own operational flexibility.

-

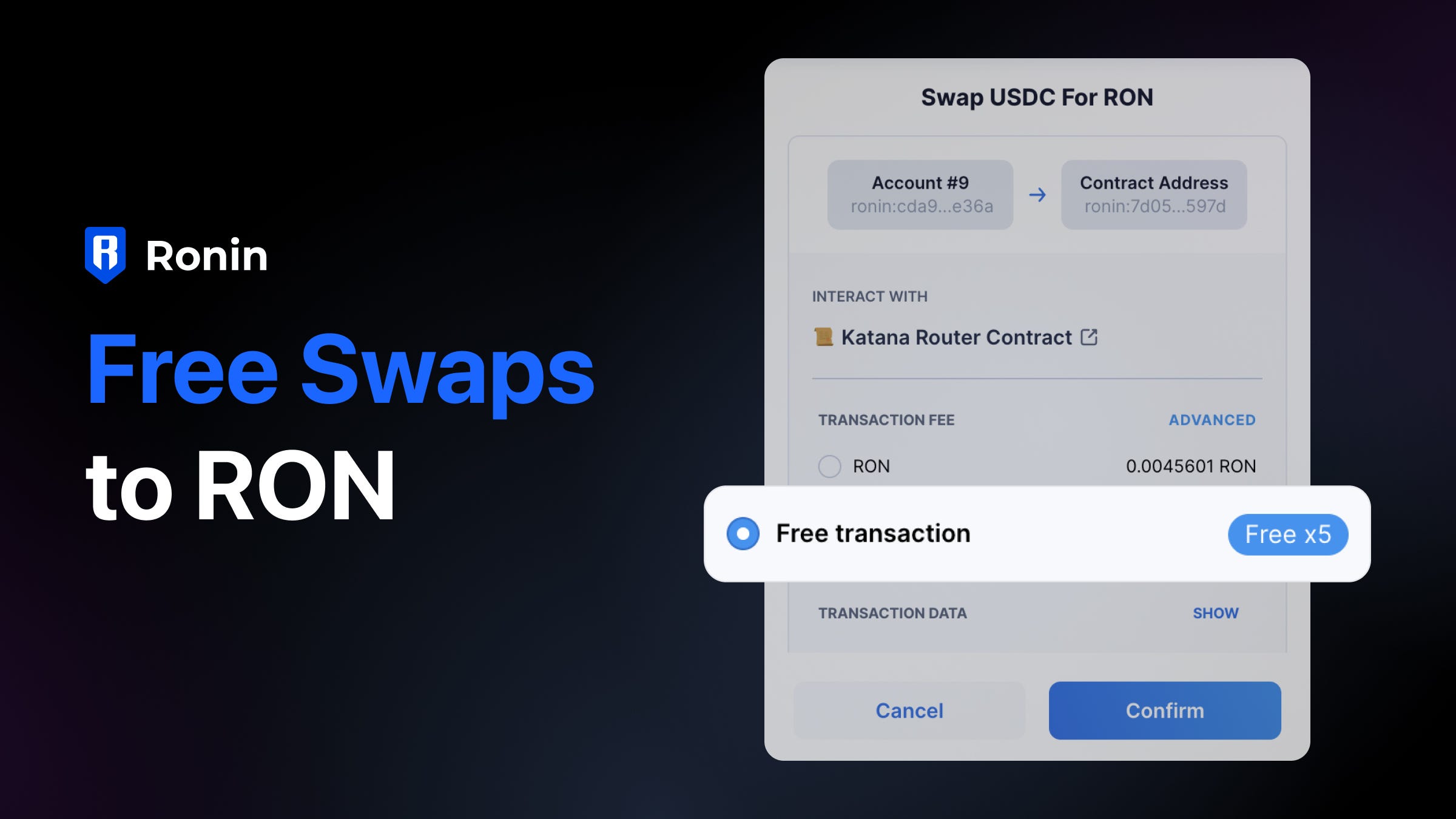

Lower Transaction Fees with RON Gas Token: Users continue to pay network fees in RON rather than ETH, reducing transaction costs and providing a seamless experience for existing Ronin users.

-

Improved Scalability and Throughput: The hybrid approach allows Ronin to batch and process large volumes of transactions off-chain, posting data to Ethereum for finality, which results in faster and more scalable dApps.

-

Developer Flexibility with zkEVM Support: Ronin’s planned integration of zero-knowledge Ethereum Virtual Machines (zkEVMs) enables developers to launch their own Layer 2 chains, fostering innovation and tailored solutions for gaming and beyond.

-

Broader Ecosystem and Interoperability: As an Ethereum-aligned L2, Ronin gains access to a wider range of dApps, DeFi protocols, and users, promoting ecosystem growth and interoperability.

-

Strategic Alignment with Institutional Adoption: By realigning with Ethereum, Ronin positions itself to benefit from Ethereum’s growing institutional adoption and its status as a leading decentralized platform.

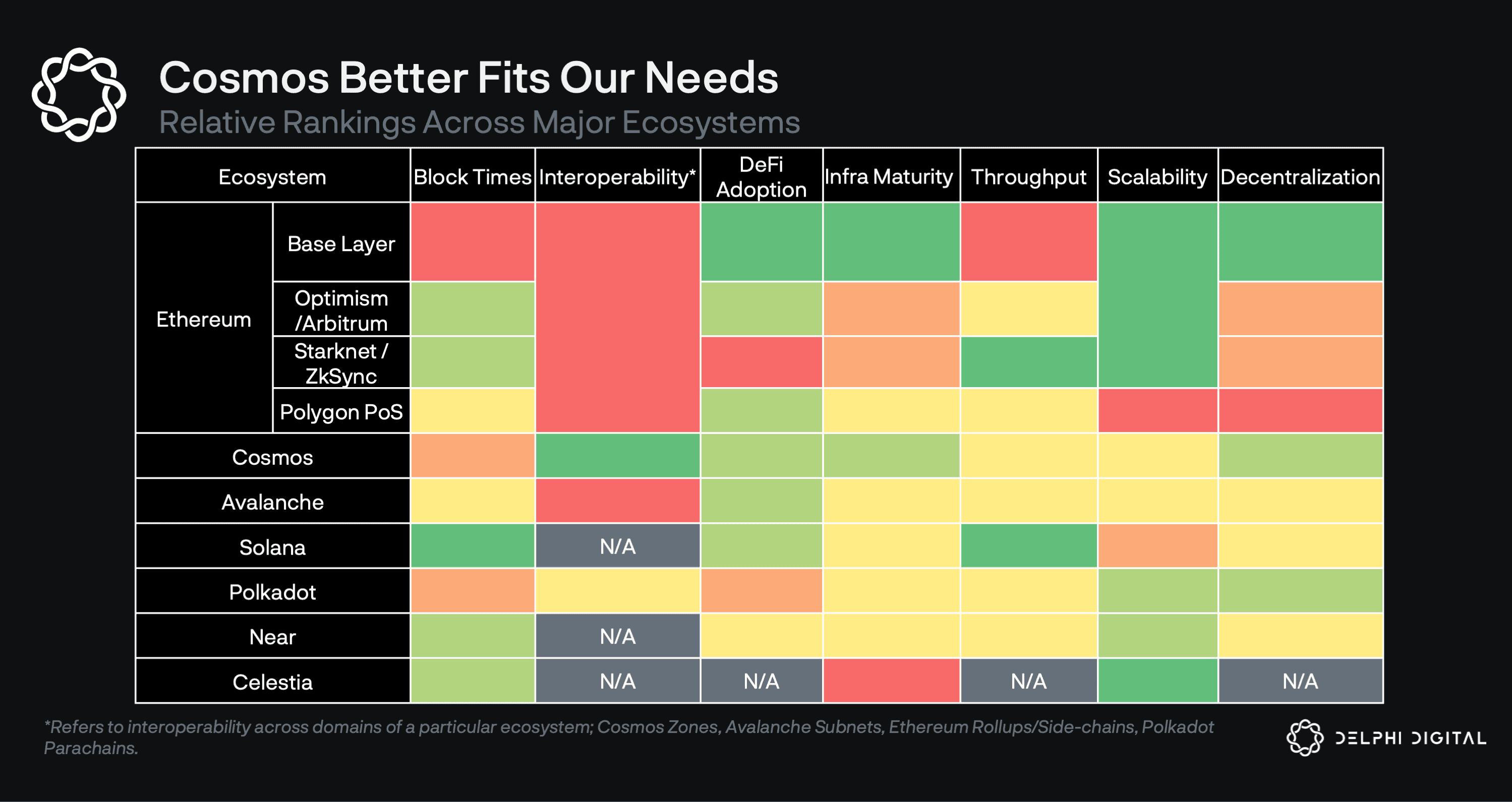

Strategic Alignment Amid Diverging Rollup Ecosystems

The timing of Ronin’s migration is notable given the current landscape of L2 innovation. Competing architectures, including Arbitrum, Optimism, Polygon zkEVMs, and even app-specific chains like Puffer, are all vying to define how best to scale Ethereum without fragmenting liquidity or compromising on decentralization (Blockworks analysis). In this context, Ronin’s decision signals confidence in the rollup-centric future while carving out its own niche through native gas economics and developer-first modularity.

The integration process is expected to be completed by Q2 2026. This timeline aligns with plans for a revamped tokenomics model aimed at rewarding developers who build on the platform, a move that could further differentiate Ronin from other L2 ecosystems focused solely on throughput or generic DeFi primitives (theblock.co coverage).

Ronin (RON) Price Prediction 2026-2031

Forecasts reflect Ronin’s transition to Ethereum Layer 2 and evolving tokenomics model. Based on current market data (RON ≈ $3.10 as of Q3 2025) and technical, fundamental, and macroeconomic factors.

| Year | Minimum Price (Bearish) | Average Price | Maximum Price (Bullish) | Year-over-Year % Change (Avg) | Key Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $2.60 | $3.85 | $5.50 | +24% | L2 migration completes; increased adoption; volatility during integration |

| 2027 | $3.20 | $4.60 | $7.10 | +19% | zkEVM launches; developer incentives; broader dApp ecosystem |

| 2028 | $3.80 | $5.35 | $8.80 | +16% | Ethereum DeFi/infra growth; gaming sector expansion |

| 2029 | $4.10 | $5.90 | $10.00 | +10% | Regulatory clarity; more L2 competition; further decentralization |

| 2030 | $4.40 | $6.50 | $11.50 | +10% | Mainstream gaming, NFT adoption; cross-chain integrations |

| 2031 | $4.10 | $7.20 | $13.00 | +11% | Matured hybrid L1/L2 model; possible new tokenomics upgrades |

Price Prediction Summary

Ronin’s price outlook is moderately bullish over the next six years, supported by its strategic migration to Ethereum Layer 2, ongoing technological upgrades, and the anticipated expansion of its gaming and DeFi ecosystem. While the transition period (2025-2026) may bring volatility, the long-term trajectory suggests gradual price appreciation as adoption grows and new use cases emerge. Bullish scenarios envision significant gains if Ronin captures a sizable share of the Ethereum L2 and gaming markets, while bearish risks remain from technical delays, increased competition, or negative regulatory shifts.

Key Factors Affecting Ronin Price

- Successful completion and adoption of Ronin’s L2 migration and zkEVM launches

- Sustained growth in Ethereum’s ecosystem and Layer 2 adoption

- Expansion of Ronin’s developer and user base beyond gaming

- Market sentiment toward Ethereum and broader crypto cycles

- Competition from other L2s (Arbitrum, Optimism, Polygon, ZKsync)

- Regulatory developments affecting gaming and DeFi tokens

- Macro market trends and institutional participation

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

As Ronin Network advances toward full Layer 2 integration, the implications for both developers and end-users are profound. The hybrid architecture not only ensures sovereign blockchain interoperability but also paves the way for a new era of Web3 gaming, where user experience is prioritized without compromising on security or decentralization. By leveraging zkEVM-based rollups, Ronin empowers projects to launch their own chains tailored to specific applications, whether high-frequency NFT marketplaces or complex DeFi protocols, while settlement and data availability remain anchored to Ethereum’s robust mainnet.

This forward-thinking approach places Ronin at the intersection of flexibility and trust. Developers can build with confidence, knowing that their applications benefit from both low-latency execution on Ronin and the economic finality of Ethereum. For users, the continued use of RON as a gas token means familiar workflows and frictionless onboarding, especially important in gaming environments where seamless UX is essential.

Future-Proofing Web3 Gaming and Beyond

Ronin’s migration is particularly significant given its roots in play-to-earn innovation. The next generation of Ronin Web3 gaming titles will be able to leverage instant settlements, microtransactions with negligible fees, and cross-chain asset transfers, all while remaining interoperable with broader Ethereum dApp ecosystems. This positions Ronin as a model for how specialized Layer 1s can evolve into modular Layer 2s without losing their unique community or economic incentives.

The competitive landscape continues to evolve rapidly. As noted in recent Blockworks coverage, major scaling ecosystems like Arbitrum, Optimism, Polygon, and ZKsync have submitted proposals to support Ronin’s transition. Their participation underscores how critical interoperability standards are becoming among sovereign chains seeking Ethereum alignment.

Key Differences: Ronin’s Hybrid Model vs. Major Ethereum L2s

-

Native Gas Token (RON) vs. ETH Fees: Ronin’s Layer 2 will continue using its own RON token for transaction fees, whereas most major Ethereum L2s like Arbitrum, Optimism, and ZKsync require users to pay gas fees in ETH. This preserves continuity for Ronin users and distinguishes its economic model.

-

Hybrid Layer 1 & Layer 2 Architecture: Unlike traditional rollup L2s that solely operate as extensions to Ethereum, Ronin is adopting a hybrid model—maintaining its own Layer 1 chain while integrating as a rollup to Ethereum. This enables sovereign chains to connect via Ronin, providing more flexibility for app-specific deployments.

-

Gaming-Centric Ecosystem: Ronin originated as a sidechain for Axie Infinity and remains focused on gaming and NFT applications. In contrast, platforms like Polygon and Optimism target a broader range of DeFi and general-purpose applications.

-

Upcoming zkEVM Support for Sovereign Appchains: Ronin plans to introduce zero-knowledge EVM (zkEVM) support, allowing developers to launch their own Layer 2 chains atop Ronin. This appchain approach differentiates it from monolithic rollups like Arbitrum One or ZKsync Era, which do not natively offer sovereign appchain frameworks.

-

Settlement and Security Inheritance: With the transition, Ronin will post transaction data to Ethereum for settlement, inheriting Ethereum’s security. While this is similar to other rollups, Ronin’s hybrid model allows for a more customizable security and scaling approach, especially for gaming and high-throughput applications.

Meanwhile, market participants are closely watching how these architectural changes will impact token value and network activity. With ETH currently priced at $3,980.50, volatility remains high as investors assess the long-term viability of various rollup strategies. The real test for Ronin will be its ability to attract new developer talent and onboard mainstream users while maintaining its reputation for fast, affordable transactions.

“By combining sovereignty with security through zkEVM rollups, Ronin is setting a precedent for future blockchain scalability solutions. “

What’s Next for Sovereign Chains Bridging to Ethereum?

The coming months will be pivotal as Ronin finalizes its migration roadmap and unveils developer incentives tied to its new tokenomics structure. Community engagement will be critical, feedback from both existing Axie Infinity users and new dApp builders will shape protocol upgrades ahead of the Q2 2026 relaunch window.

The hybrid Layer 1/Layer 2 paradigm championed by Ronin offers a blueprint for other sovereign blockchains seeking scalable yet secure connections to Ethereum. As more networks adopt similar models, balancing autonomy with shared security, the ecosystem moves closer to realizing seamless composability across diverse applications.

Ronin (RON) Price Prediction 2026-2031

Forecasting RON’s Price Trajectory Post-Ethereum Layer 2 Migration

| Year | Minimum Price (Bearish) | Average Price | Maximum Price (Bullish) | Year-over-Year % Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $1.10 | $1.85 | $2.90 | +28% | Migration to Ethereum L2 complete; initial adoption phase, moderate volatility |

| 2027 | $1.40 | $2.40 | $3.80 | +30% | Growing adoption, zkEVM/rollup ecosystem expands, gaming & dApp traction |

| 2028 | $1.70 | $3.10 | $5.00 | +29% | Broader DeFi integration, developer incentives, Ethereum bull cycle support |

| 2029 | $2.10 | $4.00 | $6.80 | +29% | Ronin becomes a leading L2 for Web3 gaming, increasing institutional interest |

| 2030 | $2.60 | $5.10 | $8.50 | +28% | Mainstream gaming partnerships, improved tokenomics, cross-chain interoperability |

| 2031 | $3.20 | $6.30 | $10.30 | +24% | Matured ecosystem, potential for major gaming franchises, robust DeFi and NFT activity |

Price Prediction Summary

Ronin (RON) is positioned for significant growth as it transitions to an Ethereum Layer 2 solution, benefiting from Ethereum’s security and scalability while maintaining its gaming-focused ecosystem. Post-migration, RON’s price is expected to trend upward, reflecting increased adoption, developer activity, and broader DeFi integration. While market volatility and regulatory uncertainties remain, Ronin’s strong developer community and unique gaming use case could drive substantial price appreciation over the next six years.

Key Factors Affecting Ronin Price

- Successful execution of Ethereum Layer 2 migration and zkEVM implementation

- Expansion of Ronin’s ecosystem beyond gaming (DeFi, NFTs, dApps)

- Adoption by new game studios and mainstream gaming partnerships

- Ethereum’s overall market performance and Layer 2 adoption trends

- Regulatory clarity for gaming tokens and Layer 2 solutions

- Competition from other Ethereum L2s (e.g., Arbitrum, Optimism, Polygon)

- General crypto market cycles and investor sentiment

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.