Ronin Network’s evolution from a dedicated sidechain for Axie Infinity to a cutting-edge Ethereum Layer 2 (L2) solution has redefined the landscape of Web3 gaming. Today, Ronin leverages the OP Stack and zkEVM technology, delivering staggering improvements in transaction speed, cost efficiency, and developer flexibility. With real-time market data showing RON trading at $0.3778, Ronin’s technical upgrades are not just theoretical advancements, they are already making waves in the ecosystem and reshaping how games like Pixels Online and Axie Infinity operate on-chain.

Ronin OP Stack zkEVM: The Engine Behind Sub-200ms Block Times

The integration of Optimism’s OP Stack with Ronin’s zkEVM architecture is a game-changer for blockchain gaming infrastructure. By blending optimistic rollups with zero-knowledge proofs, Ronin achieves block times as low as 90 milliseconds, enabling near-instant in-game transactions and asset transfers. This performance leap empowers game developers to build interactive experiences that feel as seamless as traditional online games, without sacrificing decentralization or security.

The result? Players can trade NFTs, swap tokens, or bridge assets between L1 and L2 games without frustrating delays. For context, Ethereum mainnet block times typically hover around 12 seconds; Ronin’s sub-200ms finality is a quantum leap forward for Web3 gaming scalability. For further technical breakdowns on how these innovations work under the hood, see our deep dive at this guide.

96% Lower Gas Fees: Making Web3 Gaming Affordable

One of the most significant pain points for both gamers and developers has always been gas fees. On Ethereum mainnet, high transaction costs can quickly erode user experience, especially for games requiring frequent microtransactions or asset swaps. With zkEVM rollups on the OP Stack, Ronin slashes gas fees by up to 96%, creating an environment where even high-frequency gameplay remains economical.

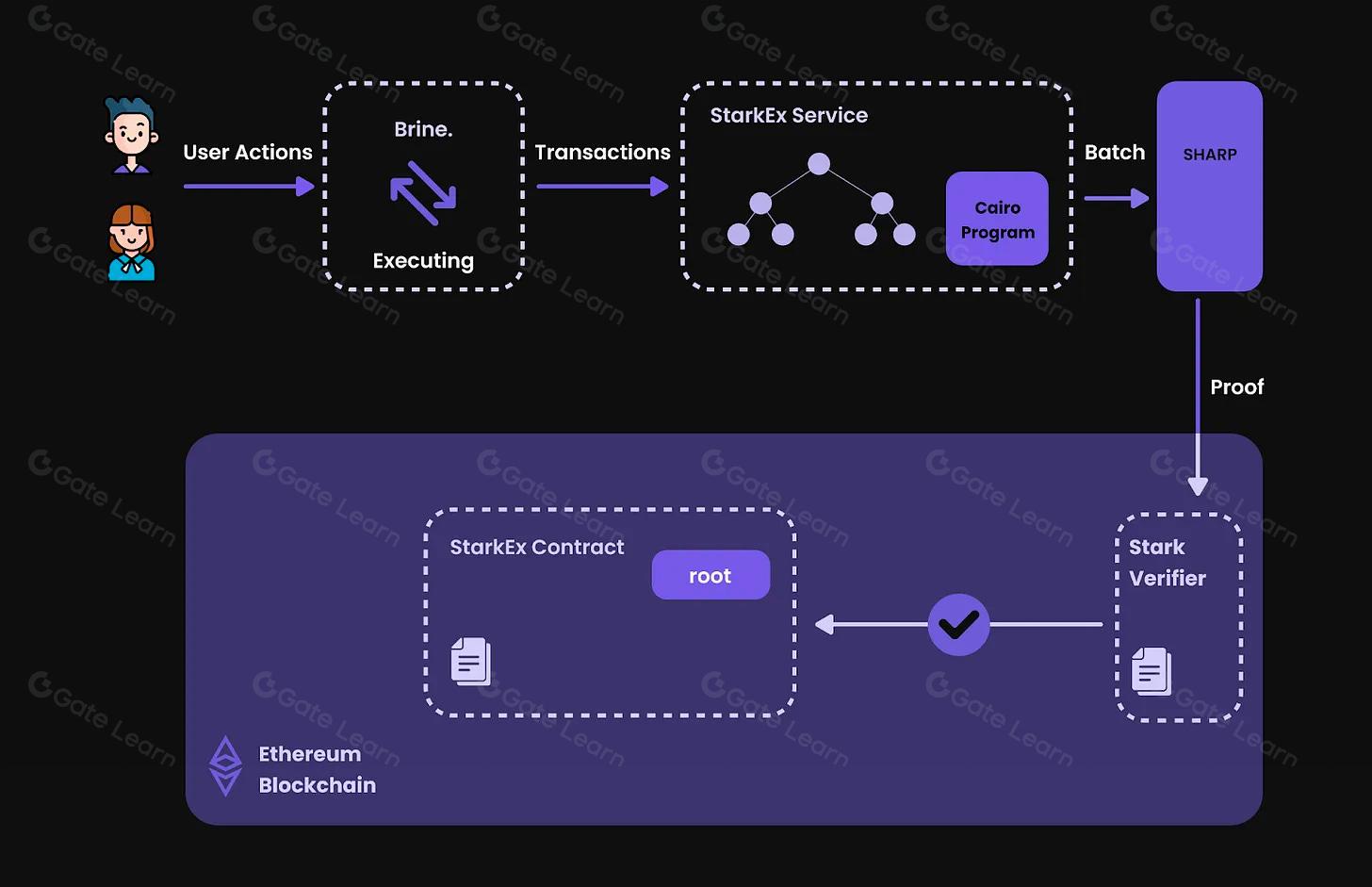

This dramatic reduction is achieved by batching transactions off-chain and submitting succinct zero-knowledge proofs back to Ethereum for settlement. Not only does this lower costs, but it also preserves Ethereum-level security guarantees, a critical factor as more value flows into Web3 games.

The impact is tangible: players can mint NFTs or send assets across games without worrying about prohibitive fees, while developers can experiment with richer gameplay mechanics that would be infeasible on costlier chains. For a comparison of how Ronin gas fees stack up against other networks, check out our analysis at this resource.

Custom Chains for Game Studios: Tailored Scalability

No two games are alike, and neither are their blockchain requirements. Recognizing this diversity, Ronin now allows studios to deploy their own custom L2 chains atop its core infrastructure. This modular approach means each game can optimize its own parameters: block time targets, fee models, tokenomics structures, and even privacy features if needed.

The benefits extend beyond performance tuning. Custom chains enable isolated environments for testing new economic models or integrating unique NFT standards without affecting the broader network. This flexibility is especially valuable for large-scale projects seeking both interoperability within the unified Ronin ecosystem and autonomy over their in-game economies.

Ronin (RON) Price Prediction 2026-2031

Professional outlook based on Ronin’s OP Stack zkEVM upgrades and Web3 gaming ecosystem growth

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.33 | $0.48 | $0.65 | +27% | Base adoption of zkEVM and L2 gaming, moderate market recovery |

| 2027 | $0.41 | $0.62 | $0.85 | +29% | Web3 gaming expansion, increased developer activity, possible regulatory headwinds |

| 2028 | $0.54 | $0.78 | $1.10 | +26% | Mainstream L2 gaming adoption, NFT/game asset trading volume up |

| 2029 | $0.70 | $1.05 | $1.50 | +35% | Potential bull cycle, Ethereum ecosystem synergy, new AAA games |

| 2030 | $0.85 | $1.35 | $1.95 | +29% | Wider blockchain gaming adoption, cross-chain interoperability |

| 2031 | $1.05 | $1.70 | $2.50 | +26% | Mature L2 ecosystem, Ronin as a leading gaming chain, global crypto acceptance |

Price Prediction Summary

Ronin (RON) is well-positioned for steady growth through 2031, driven by its zkEVM and OP Stack upgrades, which enhance scalability, speed, and developer flexibility. As Web3 gaming matures and adoption rises, RON could see significant appreciation, especially during broader crypto bull cycles. However, prices will remain sensitive to market cycles, competition, and regulatory changes.

Key Factors Affecting Ronin Price

- Adoption of Ronin zkEVM and OP Stack by developers and gaming studios

- Growth in Web3 gaming user base and transaction volumes

- Ethereum Layer 2 ecosystem expansion and interoperability

- Competition from other gaming-focused blockchains (e.g., Immutable, Polygon)

- Overall crypto market cycles (bull/bear trends)

- Regulatory developments impacting gaming tokens and NFTs

- Macro factors such as global crypto adoption and investor sentiment

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Unified Gaming Ecosystem: Seamless Interoperability Across Titles

By connecting Layer 1 and Layer 2 environments through robust bridges, and leveraging zkEVM compatibility, Ronin enables effortless movement of assets between flagship titles like Pixels Online and emerging projects yet to launch. Token swaps and NFT trades flow smoothly across chains with minimal friction or delay.

This unified approach not only boosts player liquidity but also fosters collaborative events between studios, think cross-title tournaments or shared virtual economies, all secured by Ethereum’s battle-tested consensus mechanisms.

Perhaps the most overlooked aspect of Ronin’s OP Stack zkEVM architecture is how it future-proofs Web3 gaming. The network’s modular design ensures that as new cryptographic advancements and game mechanics emerge, developers can rapidly iterate and integrate without major overhauls. This adaptability is crucial in a sector where user expectations and technical standards evolve at a breakneck pace.

Developer Experience: Familiar Tools, New Possibilities

Ronin’s EVM compatibility means that studios can tap into the vast library of existing Ethereum developer tools, smart contract templates, and security best practices. Teams migrating from Ethereum or other EVM-compatible chains face minimal friction, accelerating time-to-market for new games. The addition of zkEVM further enhances this experience by supporting advanced privacy features and efficient proof generation, key for both compliance-oriented projects and those seeking to innovate on gameplay logic.

This robust infrastructure has already attracted some of Web3’s top games. Pixels Online, for example, leverages Ronin’s instant finality to power its bustling player-driven economy, while Axie Infinity continues to push the boundaries of play-to-earn models on-chain. These successes underscore why Ronin is becoming the default home for ambitious blockchain gaming projects.

Security and Interoperability: Ethereum-Level Guarantees

With its transition to an Ethereum Layer 2 via Optimism’s OP Stack, Ronin inherits battle-tested security from Ethereum mainnet while maintaining its own high throughput. Zero-knowledge proofs ensure that even as transaction volume grows, data integrity remains uncompromised. This is particularly important as cross-chain bridges become more heavily used, vulnerabilities here can have ecosystem-wide consequences.

Moreover, interoperability isn’t just a buzzword in Ronin’s case; it’s an operational reality. Assets can be bridged not only between games on Ronin but also back to Ethereum or other EVM-compatible networks if desired. This flexibility lets players truly own their assets across multiple platforms, a foundational promise of Web3 realized at scale.

Market Impact: RON Price Holds Steady Amid Upgrades

As of October 25th, 2025, RON is trading at $0.3778, reflecting market confidence in the network’s technical direction despite broader volatility in digital assets. While short-term price action saw a modest 24-hour dip of -0.0105%, the long-term fundamentals are bolstered by continuous protocol upgrades and growing developer adoption.

The introduction of custom chains and zkEVM features positions RON as more than just a governance token, it becomes an essential utility for accessing blockspace within one of Web3 gaming’s largest ecosystems. For more on how these developments might influence RON price action in the coming quarters, see our predictive analysis above.

The bottom line: With block times under 200 milliseconds, gas fees reduced by up to 96%, and a flexible framework for custom game chains, Ronin Network stands out as a blueprint for scalable Web3 gaming infrastructure. As interoperability deepens between L1s and L2s, and as top titles continue to launch on Ronin, the platform will likely set new standards for performance and user experience in blockchain gaming.

If you’re interested in learning more about how these innovations are transforming developer workflows or want deeper technical analysis on rollup mechanics, explore our related coverage at this page.